Building Wealth and Security: How Financial Planning Can Help

In the realm of financial planning services, our firm prides itself on its versatility in servicing both personal and corporate clients. We understand that the financial needs and goals of individuals may differ greatly from those of businesses. Our commitment to delivering customized, client-centric solutions ensures that we meet the unique requirements of all our clients, from individuals seeking financial peace of mind to companies striving for financial success.

What is Financial Planning?

Wouldn’t it be great to have an idea or a snapshot of what your own unique future would look like? A financial plan does just that. Through the planning process, your goals are defined, your concerns are addressed and you gain clarity for the next steps in your financial journey.

A financial plan will usually include a thorough analysis of your current financial situation and a recommended action plan customized to your unique situation. Through meetings with your AWP advisor, your personal values, goals, and objectives will be identified and will help ensure your plan aligns with what is most important to you.

A financial plan is a dynamic document and should be continuously updated as your personal situation changes and/or tax laws get updated.

Why is Financial Planning Important?

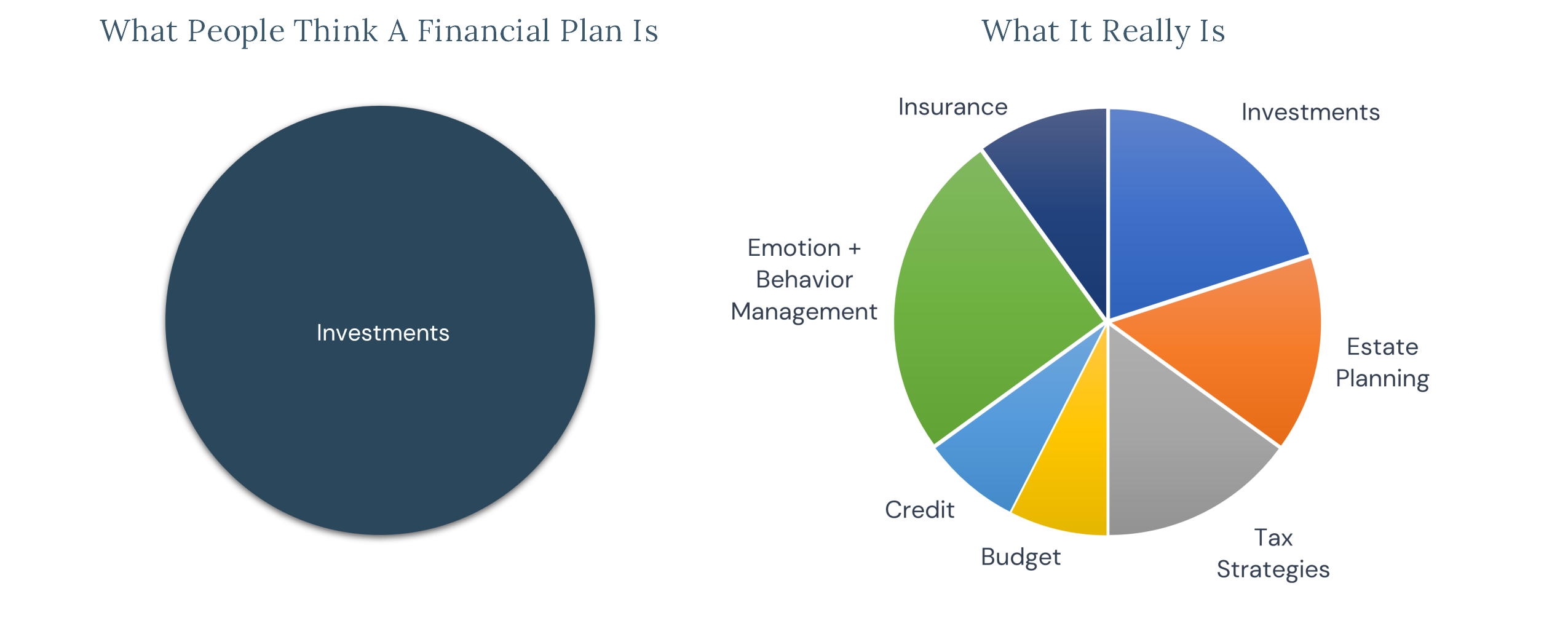

Key Components of Financial Planning

- Setting Financial Goals – Identify your short-term and long-term financial objectives. These could include buying a home or a rental property, saving for a child’s education, building an emergency fund, or retiring comfortably.

- Net Worth Statement – A financial plan is your map to the future, a net worth statement is the snap shot of where you are today. Monitoring changes overtime is a good way to measure progress.

- Cashflow – Managing cashflow is the key to success of many financial plans. A good plan will allocate cashflow (income, expenses & savings) efficiently to your various priorities. It may also illustrate future cashflows, for example in retirement or a career change.

- Investing – Explore investment options that align with your risk tolerance and financial goals. How you invest your savings will impact your wealth accumulation.

- Risk Management – Protect your family and your assets with insurance coverage for life, disability and critical illness.

- Estate Planning – Get your assets into the right hands quickly, easily, and tax effectively. A little estate planning and communication can make a huge difference for your heirs. Take care of yourself with a power of attorney and a representation agreement.

Financial planning is a critical aspect of building a secure future and achieving your financial aspirations. By setting clear goals, managing your resources wisely, and leveraging the right tools and resources, you can take control of your financial destiny. Start your journey toward financial security today!

Contact Us

Schedule a no-obligation, complimentary meeting today. Find Alitis Wealth Services in Campbell River at 101-909 Island Highway, in the Comox Valley at 103-695 Aspen Rd., in Victoria at 1480 Fort St., and online at alitis.ca/wealth-planning. For more information, call 1-800-667-2554 or email info@alitis.ca.