Overview

The Alitis Private REIT is a diversified portfolio of alternative investments with a focus on private real estate and a mix of income-producing and development projects. The Fund is designed to generate a moderate level of income and tax-efficient capital appreciation over the long-term.

How could the Alitis Private REIT fit into your portfolio?

The Alitis Private REIT was created for investors with a 6 years and longer time horizon looking to add a real estate component. The Alitis Private REIT has a multi-manager/multi-strategy structure which provides exposure to a wide range of real estate types, geographic regions and manager expertise, making this fund attractive to those seeking to add a well-diversified real estate solution to their portfolios.

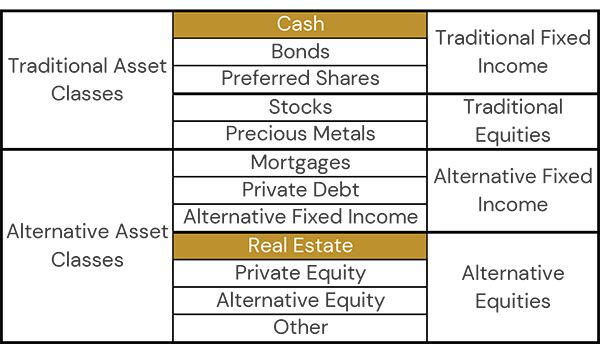

What Asset Classes Does This Fund Use?

How is the Private REIT managed?

In order to maximize risk-adjusted returns through various real estate market cycles, we specifically use three strategies (Income Producing, Renovation and Development) that contribute to stable income and capital appreciation.

- Income Producing

- Newly constructed modern pet-friendly apartments generally located in secondary markets.

Properties generally offer amenities including gym, business center, games room and an outdoor patio as well as private balconies and in-suite laundry.

- Renovation

- Repositioning the properties through heavy value-add upgrades to the common areas (lobby, elevator, exterior etc.) as well as in-suite remodeling, generating a significant uplift in rents.

- Development

- Alitis partners with trusted and experienced developers to create desirable multifamily income producing properties, as well as, for-sale condo and townhouse projects.

Development risk is reduced by mitigating entitlement (zoning & development permits) timeframes and establishing fixed price construction contracts where possible.