Overview

The Alitis Dividend Growth Pool is a traditional growth-oriented portfolio focuses on generating dividend income along with capital appreciation over the long-term. The main features include:

- Incorporates a mix of Canadian and international dividend-producing investments.

- Canadian dividends may provide tax efficiency in taxable accounts.

- Provides long-term growth potential for your portfolio.

How could the Alitis Dividend Growth Pool fit into your portfolio?

The Alitis Dividend Growth Pool was created for investors with a 4 year and longer time horizon who are looking to achieve strong growth with reduced taxes. Designed to optimize the payout of tax-efficient Canadian eligible dividends and harness the potential for growth of global companies, making it ideal to be held in your taxable personal, joint and corporate accounts.

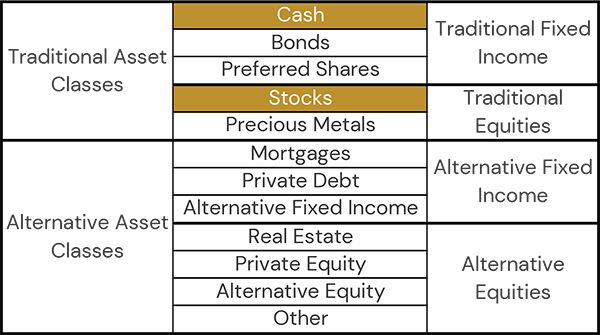

What asset classes does this fund use?

The Alitis Dividend Growth Pool is permitted to invest in cash and traditional stocks, as indicated below:

How is the Alitis Dividend Growth Pool managed?

The premise behind this Pool is to generate a high level of dividend income by investing both within Canada and internationally. It is anticipated that the dividend income from the international investments will cover the costs of the Pool and leave mostly eligible Canadian dividends to pay out to unitholders. This structure provides the opportunity to achieve higher growth outside Canada along with the tax benefits of investing in Canada. From a portfolio construction perspective, the Dividend Growth Pool split roughly in half to mitigate risk:

- Half Managed by Alitis – About half of the Canadian and half the international investments are managed by Alitis using atop-down allocation approach to tilt the portfolio to where we anticipate better returns to occur. This is done by using low-cost exchange-traded funds, but we will likely start investing directly into individual stocks in the coming years.

- Half External Managers – As is our usual practice at Alitis, this Pool utilizes external managers to oversee a portion of the portfolio. The other half of the Canadian and international portions of the portfolio are externally managed so that different perspectives on how to pick dividend-paying investments are represented in the Pool.

At times the proportions may vary, particularly if the decision has been made to hold some monies in cash if investment conditions appear unfavourable.