What is Private Debt?

At Alitis we include a variety of asset classes within a client’s portfolio with the goal of reducing risk to provide better risk-adjusted returns. One of these asset classes is Private Debt, which forms part of the Alitis Strategic Income Pool and the Alitis Income and Growth Pool.

But what is private debt and how is it helping your investment portfolio at Alitis?

Private Debt

Private Debt Investments are loans made to individuals and companies that are not created or financed by the banks, nor are they traded in the open market. These are loan contracts that are individually negotiated between the lender and the borrower.

With these negotiated contracts a private debt company can set specific criteria for the loan’s interest rate, term, covenants, charges, and other factors. The debt provider conducts a thorough due diligence on the borrower using various risk and credit metrics to increase the likelihood that the principal and interest payments are paid in full and in a timely manner. The risk and credit committees and the underwriting teams secure extra protection against potential losses by obtaining collateral against the loans. Collateral can be in the form of real assets (buildings, land, inventory, and equipment), revenue, receivables, or it can be backed by the overall company or the owners of the company. It’s these extra levels of protection that provide more certainty to the borrowers’ profile and their ability to meet their debt obligations.

Borrowers use private debt companies for a variety of reasons including increasing working capital, financing business growth, or significant capital expenditures. These borrowers often have relationships with banks and have access to traditional financing solutions. However, banks often take too long to approve a loan or have restrictions that might inhibit loan flexibility. This is when private debt provides the solution.

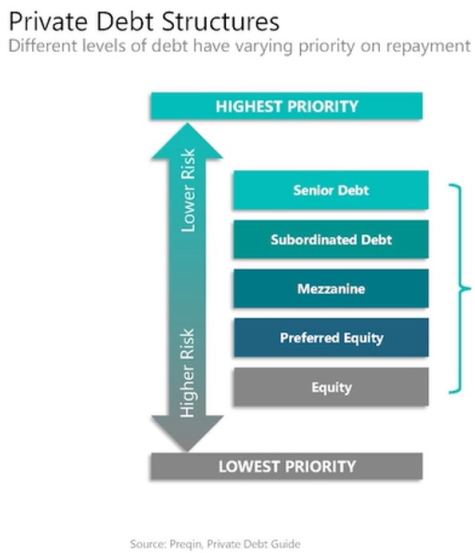

One important feature of private debt is its precedence in the company’s capital structure. Private debt can be mezzanine, subordinated or senior debt and all these loans rank above equity (stock ownership) and preferred shares. This protects the capital of the of private debt holders because in the case of a default, senior, subordinated and mezzanine debt, gets paid first (in that order).

How does it help your portfolio at Alitis?

Private Debt investments, due to being customized for each borrower and their unique situation, generally achieve higher returns than traditionally traded market debt securities. As mentioned above, there is no secondary market for these loans, so higher potential returns are the compensation for this reduced liquidity.

Because the loans are not publicly traded, they are not marked to market daily which allows the investment to react differently than bond investments in the public markets. In finance when an investment reacts differently than another investment, we say that these investments are non- correlated. When these non-correlated private debt investments are added, the entire portfolio gets the benefit of diversification with risk, as measured by standard deviation, being reduced.

So, adding private debt to a portfolio may increase returns (higher interest rates/yields) and reduce risk (low, no, or negative correlation). That is a good thing and that is why we add private debt to our portfolios at Alitis.

I thought it might be helpful and interesting to highlight a specific type of private debt that we hold at Alitis. This type of private debt is called Factoring.

Factoring

Imagine that you are small business owner, and your business is making packaged lasagnas for sale at Costco in Canada. Now imagine that you just delivered 5,000 units of your famous lasagna to Costco and issued an invoice to Costco for $40,000 (they owe you). Depending on the terms of the invoice, Costco might not pay you for 30-90 days. But then, what if Costco asked you for another 5,000 units? What if you didn’t have the cash to buy the pasta, tomato sauce and meat that you’ll need until they pay you for the first delivery? What do you?

You get in touch with a factoring company. These companies will purchase your invoice (account receivables from Costco) for a discount and then collect from Costco in 30-90 days. You will get the money you’ll need for the next order from the factoring company (perhaps 90 cents on a dollar) while the factoring company will receive full payment of the invoice from Costco at a future date.

I hope this has given you a little more information about private debt and why Alitis uses these investments as a part of your investment portfolio. Now the next time you place a lasagna in the oven at 375◦ for 55 minutes maybe you’ll think about factoring and your Alitis Portfolio.

If you would like to learn more about private debt, or the other asset classes we use at Alitis, please reach out to one of our advisers.