Stock Market Volatility Is A Megaphone for Other Financial Woes

April 13, 2020: COVID cases increase in the U.S. and U.S. stocks fall before the start of one of the most uncertain earnings seasons on record as the coronavirus pandemic rattles the global economy. – Equity Markets collapse with the S&P 500 index dropping 2.5%.

April 14, 2020: Donald Trump tweets “We’re very close to completing a plan to open our country.” – Stock Markets surge with signs of the coronavirus outbreak either leveling off or easing (S&P 500 is up 3.06%).

Welcome to the world of volatile financial markets.

In recent days, the increased volatility in financial markets has resulted in renewed anxiety for many investors. While it may be difficult to remain calm during a substantial market decline, it is important to remember that volatility is a normal part of investing. Additionally, for long-term investors, reacting emotionally to volatile markets may be more detrimental to portfolio performance than the market drop itself.

Greed and fear are considered the two greatest market movers in the world of investing. Contrary to popular opinion, volatility does not create greed and fear, rather it acts as an amplifier, kind of a MEGAPHONE, and raises “GREED” and “FEAR” to such prominence.

Greed and fear exist everywhere, and these two reactions play a major part in our everyday lives. In times of relative certainty and routine, we deal with greed and fear more systematically and thoughtfully. We feel calmer and have more time to consider multiple options and make rational decisions. In times of relative uncertainty and chaos, we are faced with amplified “GREED” and “FEAR”. We feel rushed and pressured to make choices, often without having all the information or time to give a decision the consideration it requires.

In some areas of our lives, this drive to action in stressful scenarios is helpful, as we take the dose of adrenaline like a hero in an action movie (Think of how James Bond knows exactly what to do in life-threatening situations to survive). But this is not always the case. In financial markets, greed and fear are not helpful.

Markets occur in cycles and will naturally have periods of higher and lower performance. Greed and fear pressure us to think that markets are linear, and we use short timeframes to extrapolate out unrealistic scenarios. Over time, financial markets are driven back to more realistic expectations.

Our job at Alitis does not involve adventuring alongside Indiana Jones or battling for the Iron Throne. We do not need to rely on greed and fear to spur us into action. We are honest about the existence of greed and fear in the market and ourselves, but we strive to not let it drive our decision-making process. Instead, we rely on analysis, experience, and the lessons of market history to guide the direction of our portfolios.

Our goal is to provide security and growth of financial assets for our clients. One of the key tools that Alitis deploys is the inclusion of alternative asset investment classes (such as Private Real Estate and Private Mortgages) to reduce the volatility of our portfolios. We reduce the power of the volatility megaphone, and this assists both our team and our clients in resisting the calls of GREED and FEAR. Let us look at our portfolios’ volatility metrics.

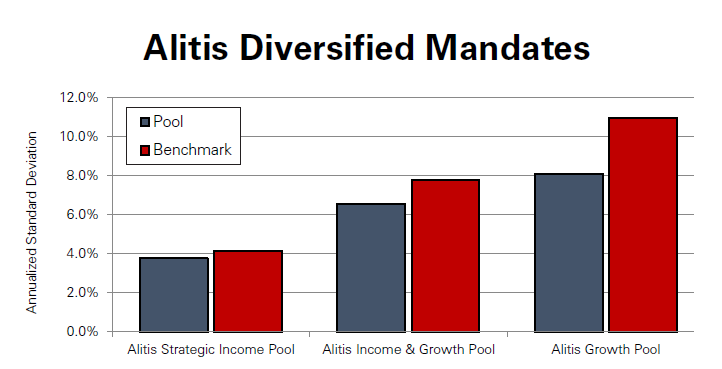

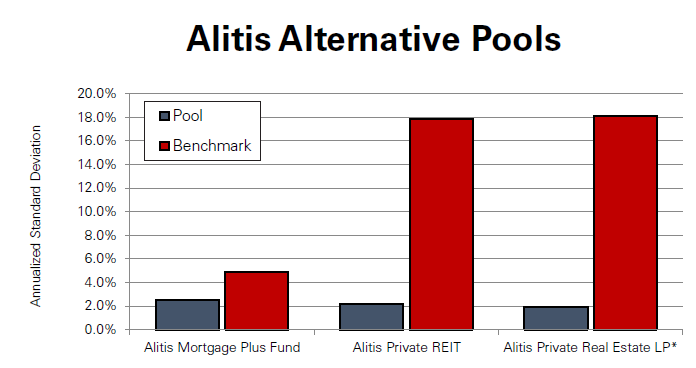

The most common measure of volatility in financial markets is the annualized standard deviation of monthly returns, using three-years of monthly returns as the only inputs. This can be used to estimate a range of expected future returns based on historical results. A smaller level of volatility for a comparable mandate (each fund as compared with its benchmark) is preferred.

Here are two charts showing how the Alitis Pools have performed compared with their benchmarks as of the end of March 2020.

As shown by the results, we have been successful in reducing the risk of our investment portfolios over the last three years. The lower risk mandate, the Alitis Strategic Income Pool, has had 9% less volatility than its benchmark. The balanced mandate, the Alitis Income & Growth Pool, has had 16% less volatility compared to its benchmark. The higher risk mandate, the Alitis Growth Pool, has experienced 26% less volatility than its benchmark.

For our Alitis Pools that are focused directly on specific alternative asset classes (Alitis Mortgage Plus Fund, Alitis Private REIT and Alitis Private Real Estate Limited Partnership), they indicate the reduced levels of volatility by incorporating private investments. It is important to remember that we generally view these as a component of a portfolio and not a complete portfolio in themselves, as they are concentrated on single asset classes and have different kinds of inherent risk.

Risk Level:

| Alitis Strategic Income Pool | Alitis Income & Growth Pool | Alitis Growth Pool | |

| 3yr Pool | 3.77% | 6.56% | 8.09% |

| 3yr Benchmark | 4.13%1 | 7.76%2 | 10.95%3 |

| Risk Reduction | 9% | 16% | 26% |

| Alitis Mortgage Plus Fund | Alitis Private REIT | Alitis Private Real Estate LP* | |

| 3yr Pool | 2.50% | 2.19% | 1.95% |

| 3yr Benchmark | 4.91%4 | 17.88%5 | 18.10%6 |

| Risk Reduction | 49% | 88% | 89% |

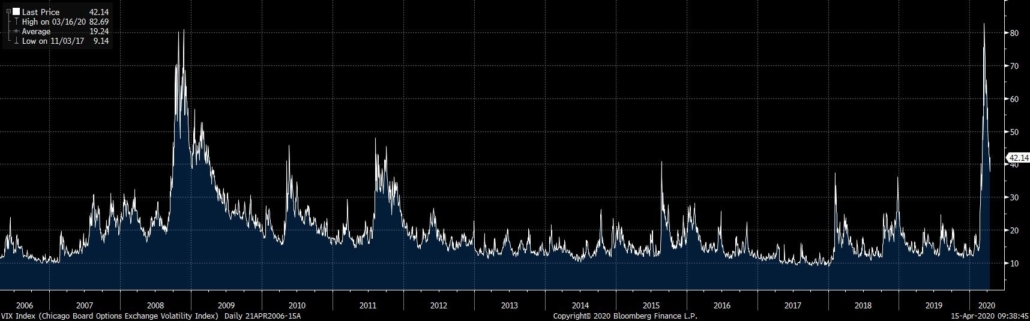

The volatility of U.S. stocks surged to record levels after benchmark indexes suffered the biggest rout since 1987 in mid-March 2020. The CBOE Volatility Index, or VIX, is a real-time market index representing the market’s expectations for volatility over the coming 30 days. Investors use the VIX to measure the level of risk, fear, or stress in the investment markets. This is not a perfect comparison to the Alitis Pools’ risk metric but provides a sense of investor sentiment and market volatility in the U.S. stock markets.

CBOE Volatility Index, better known as the VIX, spikes to new highs in March 2020

When events impact the entire world, nobody is immune to the drivers of greed and fear. Markets could continue to roil up and down for months to come, trying to shake us off balance. Perhaps the best tip for maintaining our peace of mind in these times comes from how to learn to walk on a balance beam. Do not look down, do not look at your toes; choose a focal point in front of you and move towards it.

Please reach out to us if you would like to discuss further and find your focal point. As you know, we continue to work diligently through this time and our Wealth Management Team is available via phone and email to answer your questions.

Sincerely,

Apurva Parashar, MBA, CAIA, CIM

Chartered Investment Manager

Thomas Nowak, BComm.

Research Associate

Disclaimers and Disclosures

*Alitis Private Real Estate LP is since inception (2 years, 11 months)

- Benchmark may change over time. Benchmark is currently: 100% FTSE TMX Bond Universe

- Benchmark may change over time. Benchmark is currently: 30% FTSE TMX Bond Universe, 30% MSCI World Index (C$), 15% TSX Capped Real Estate, 5% Dow Jones Real Estate and 20% FTSE TMX All Corporate Bond

- Benchmark may change over time. Benchmark is currently: 100% MSCI World Index (C$)

- Benchmark may change over time. Benchmark is currently: 100% FTSE TMX All Corporate Bond

- Benchmark may change over time. Benchmark is currently: 75% TSX Capped Real Estate, 25% Dow Jones Real Estate

- Benchmark may change over time. Benchmark is currently: 75% TSX Capped Real Estate, 25% Dow Jones Real Estate