Understanding the Chartered Investment Manager (CIM®) Designation

The Process, Benefits, and Why it Matters

The Chartered Investment Manager (CIM®) designation is the industry standard for discretionary investment and portfolio management services. It is recognized by Canadian securities regulators and ensures that those who earn it are qualified to evaluate and manage all aspects of a client’s investment portfolio.¹ For those navigating the complex world of investments, working with a financial professional with the CIM® designation offers reassurance that their financial matters are managed by someone who meets high industry standards. This article delves into the process of obtaining the CIM® designation, its benefits, and the reasons why investors should consider working with someone with the CIM® designation.

What is the CIM® Designation?

Awarded by the Canadian Securities Institute (CSI), the CIM® designation is a professional certification for individuals who demonstrate advanced expertise in portfolio management and discretionary investment management. Financial professionals with the CIM® designation are licensed to manage client portfolios and can work independently or within firms as discretionary portfolio managers.

Process of Obtaining the CIM® Designation

Achieving the CIM® designation involves several key steps:

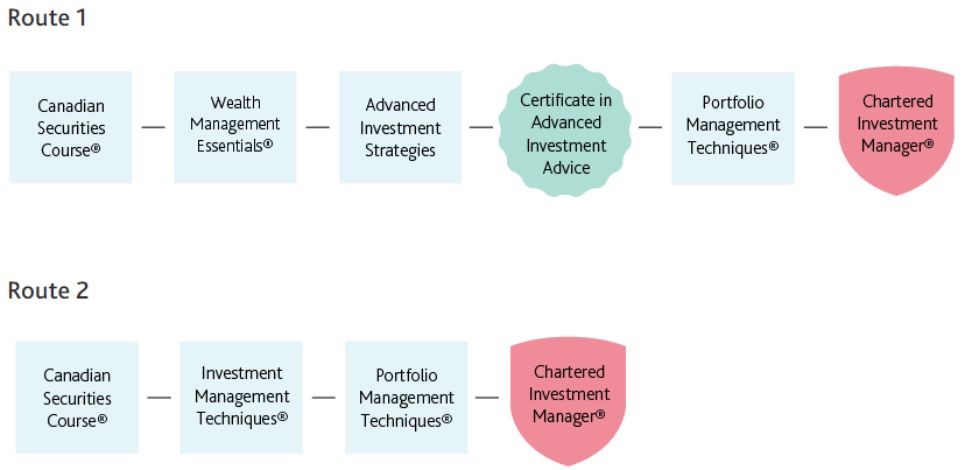

1. Education Requirements²: There are two routes possible.

To start, applicants need to complete a series of courses offered by CSI. These courses include:

- Canadian Securities Course (CSC) – This foundational course provides knowledge about financial instruments, market regulations, and investing principles.

- Wealth Management Essentials (WME) – This course provides Portfolio Managers with a holistic approach to wealth management, covering topics such as budgeting and saving, borrowing, taxation, retirement, asset allocation, portfolio monitoring and performance, and more.

- Advanced Investment Strategies – This course focuses on advanced concepts that are essential for managing complex portfolios.

- Portfolio Management Techniques – This course delivers a deeper understanding of advanced portfolio management techniques suitable for high-net-worth clients and institutional investors.

- Investment Management Techniques – This course is designed to provide a deeper understanding of applied skills such as investment policy statement development, asset allocation strategies, portfolio performance evaluation, and securities analysis.

2. Work Experience

Candidates must have at least two years of relevant work experience in the financial services industry gained within the last 5 years. This can include experience in either a retail or an institutional role or in a role that relates to, supports, or adds value to the investment management process such as investment advising, financial analysis, or portfolio management.

3. Regulatory Requirements

After completing the coursework, individuals must fulfill regulatory requirements to act as a discretionary portfolio manager, as set out in the CIM® Professional Competency Profile, ensuring they meet ethical and regulatory standards.

4. Application for CIM®

Once all courses, exams, and experience requirements are fulfilled, individuals can apply to the Canadian Securities Institute for the official designation. They must adhere to ongoing professional development to maintain their status.

Why Work with a CIM® Designated Professional?

Portfolio Management Expertise

Investors looking to entrust their portfolios to someone with advanced knowledge should consider working with a CIM® professional. These Portfolio Managers are trained to apply sophisticated portfolio management strategies, ensuring that investments align with clients’ financial goals, risk tolerance, and market conditions.

Discretionary Portfolio Management

One key advantage of working with a CIM® holder is the ability to engage in discretionary portfolio management. This means that the investment manager can make real-time decisions on behalf of the client without having to consult them before every trade. This can be particularly useful in volatile markets, where fast decisions can lead to better outcomes.

Ethical and Regulatory Adherence

CIM® professionals must follow strict ethical guidelines and comply with regulatory standards set by the Canadian Investment Regulatory Organization (CIRO). This commitment to ethics ensures that investors’ interests are always prioritized, and decisions are made with integrity.

Tailored Investment Strategies

With their advanced training, CIM® professionals are equipped to create custom investment strategies. Whether an investor is looking to grow wealth, preserve capital, or plan for retirement, CIM® holders can design strategies that are aligned with specific financial objectives.

Conclusion

For individuals seeking expert advice, working with a financial professional with the CIM® designation ensures that their portfolios are in capable hands. From portfolio construction to risk management and fiduciary duty, these professionals are uniquely qualified to help investors navigate the financial markets and achieve their long-term financial goals. At Alitis Investment Counsel, we have many team members with the CIM® designation, allowing our team to offer a well-rounded approach to wealth management.

Our Team at Alitis

Our dedicated team at Alitis has over 250 years of collective industry experience. But what makes us unique is the high level of integrity that every team member brings to the table.

Along with experience and integrity, each team member at Alitis shares the same commitment to our clients. At the end of the day, we measure our success based on the success of you reaching your financial goals.

If you’re interested in investing with Alitis, let’s have a conversation:

Disclaimers and Disclosures

- “Chartered Investment Manager (CIM®).” Canadian Securities Institute, 17 Jan. 2024, www.csi.ca/en/credentials/cim.

- “Chartered Investment Manager (CIM®) Requirements.” Canadian Securities Institute, 10 May 2024, www.csi.ca/en/credentials/cim/requirements.