Top 3 Fears For Most Financial Investors

Signs of the emergence of second wave COVID-19 cases and the risk of further deterioration of U.S.-China relations are causing a slump in the stock markets. There is also no denying the fact that as the US & Canada relief packages run out in the near future and the levels of unemployment remain significantly high, the fundamentals remain grim and the future is hard to predict.

In such times, it is natural to have apprehensions and fears regarding investing, but we are here today to debunk some of the more common myths about investing and provide our perspective.

#1: I will lose all my money by investing

Some individuals believe that the financial markets are risky and that nobody ever beats the market. The truth is that investments will have positive and negative periods of return, but having a long-term investment strategy and sticking to it, is the best method for growing your wealth over time.

Investing is not a gamble, rather it is the mechanism used for generating returns by purchasing investable assets. Investments are priced using future expected returns, and thus entail some degree of risk, but this is calculated risk. The investments you make should be based on thorough research and due diligence, looking at investable assets both from a macro-economic and micro-economic stance (considering both qualitative and quantitative aspects, as well as how they combine into your total portfolio).

Granted one might just consider investing in Guaranteed Investment Certificates (GICs) instead of trying to get higher long-term consistent returns. But then, in today’s low-interest-rate environment, can we honestly say that we are satisfied with our investments generating 0.7% annual return (current one-year GIC return is 0.7%) which does not even keep up with inflation (2019 inflation rate in Canada was 1.95%)?

Investing is all about making informed decisions, finding the risk vs return trade-off which best fits our own investment preferences, and focusing on long-term performance instead of short-term volatility.

#2: Fear of missing out

Fear of missing out, made popular as a millennial meme, often stoked by social media, that somewhere someone was having more fun than you. It has since morphed into every investor’s concern that there is a sector, asset class, or investment that they are underexposed to that is going to be this year’s big winner. A classic example of this is when Warren Buffet, one of the most successful investors of all time and who is also known as the Oracle of Omaha, openly admitted to being too late to the game and missing out on the opportunity to invest in Amazon early on.[1]

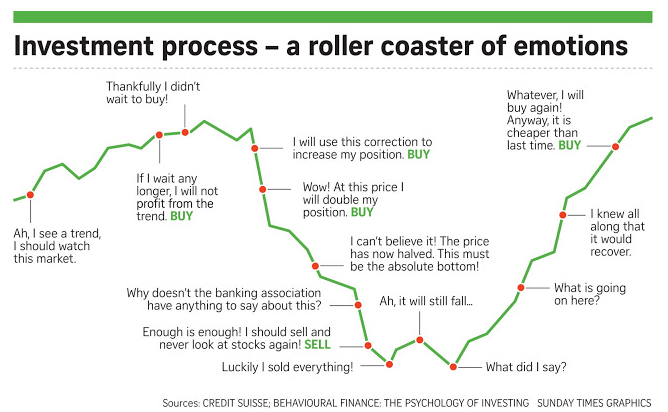

Another kind of fear of missing out is market timing – is this the right time to invest or should I be exiting the markets now? History has proved time and again that market timing has never really worked in anyone’s favor.[2] So, if you are looking for the perfect day to invest – well there is none!! It is all about knowing and understanding the asset class and the fundamentals that drive their performance – bonds, stocks, commodities, real estate, and other alternative investments are each unique and serve a different purpose.

#3: What will happen if the markets drop the year after I retire?

Let us assume that an investor retired in January 2020 at the age of 60, after having worked and saved for 30 years. Following that, the investor’s portfolio dropped in March 2020 by 20%. Does that mean he or she needs to get back to work to make up for all the money lost?

The market volatility or investment drop over a 3-month, 6-month, or even a 1-year duration should not impact how you live your life or your ability to retire. The duration of your retirement is 25-35 years (you are not spending all your hard-earned savings the year you retire but gradually over the next two or three decades). This means your investments have more or less the same time-frame to recoup the losses. Some measures such as reducing the rate of withdrawal from the investment portfolio can assist in faster recovery during periods of an extreme market correction, but your life plans can remain intact.

And that new retiree, who was pulling their hair out at the end of March 2020 with their portfolio having dropped 20%? They stuck to their plan, stayed invested, and now their portfolio at the end of August 2020 is likely back to the same level they started the year with.

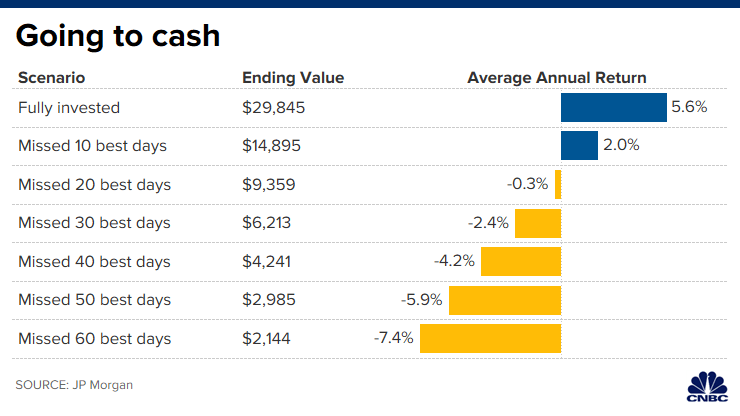

The chart below shows how $10,000 invested in the S&P 500 index, for the 20-year period of 1999 through 2018, would have performed under various scenarios.

During times of uncertainty, investors need to look beyond traditional asset classes for other sources of returns to meet their financial objectives with greater confidence. Alternative investments can provide an interesting opportunity for investors to diversify their portfolios, dampen the impact of market volatility and help them achieve their long-term investment objectives, even during times of market uncertainty. By adding alternatives like real estate, private debt, alternative fixed income, mortgages and private equity to the mix; investors could enhance portfolio performance, boost diversification and reduce their overall risk.

One of the leading commentators on personal finance, Financial Journalist Jane Bryant Quinn once said, “The market timer’s Hall of Fame is an empty room.”

Sincerely,

Apurva Parashar, MBA, CAIA, CIM

Associate Portfolio Manager

Disclaimers and Disclosures

- https://fortune.com/2018/05/06/why-warren-buffet-was-wrong-about-google-amazon/ & https://www.cnbc.com/2017/05/06/warren-buffett-admits-he-made-a-mistake-on-google.html

- https://www.rbcgam.com/documents/en/advisor-support/time-in-the-market-vs-timing-the-market.pdf