The Value of Advice in Volatile Times

Investment markets are unpredictable. Consider the past few years in which markets have faced turbulence from wars, a global pandemic, corporate bankruptcies, and surging inflation. It is important to remember that volatility is a normal part of investing.

Market timing and performance chasing has never been an effective way to achieve the most financial progress for investors and their families. The beauty of investment management, however, is that many types of advice and strategies can be measured or explained to help clients understand how they specifically benefit from their relationship with their advisor and their firm’s investment and administrative teams.

Active Rebalancing Philosophy & Behavioral Guidance1

With regular rebalancing, a client’s portfolio will more likely retain its original asset allocation, keeping the investor within their risk comfort zone while remaining appropriate for an investor’s stated goals. Higher-risk portfolios tend to experience greater volatility, which can lead to investors to make impulsive decisions driven by their emotions.

For example, 2020 was a wild ride. Many investors ran for the exit in mid-March 2020, when the S&P/TSX Composite Index registered the largest weekly decline since 2008. In fact, $14.1 billion was pulled out of long-term funds in Canada in that month.2 In 2022, we saw similar reactions as stock and bond markets declined.

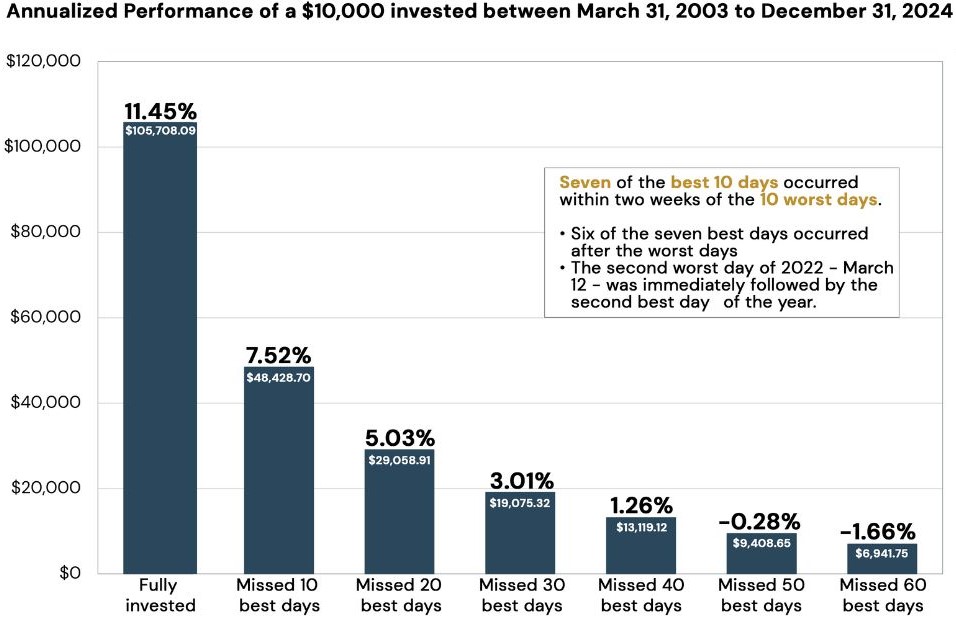

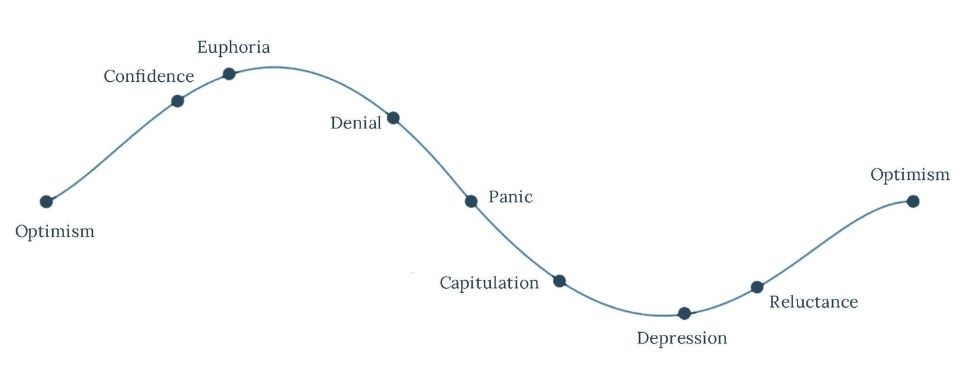

Many investors will experience a cycle of investing emotions, detailed later in the document. During periods of extreme volatility, emotions driven by “loss aversion” – the desire to avoid additional losses because losses feel more painful than gains feel good, tempt investors to sell out of the market after a significant drawdown. They plan to re-enter the market when the outlook is more promising, but it is difficult to time the market. Additionally, the best days often follow the worst, and it is important to be invested for those good days for the recovery of one’s portfolio. The chart below illustrates the difference between an untouched $10,000 investment in the S&P 500 from March 31, 2003 to December 31, 2024 to a return that is impacted by missing some of the best days as a result of premature selling.

Returns of the S&P 5003

Equity Performance in the Long Run3

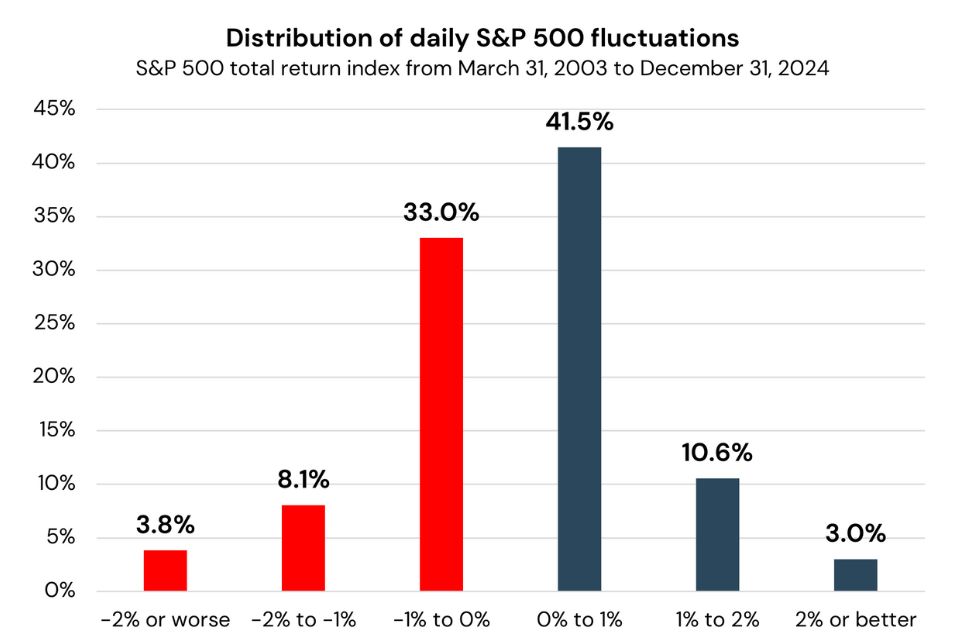

Market fluctuations are normal. Market indexes see gains and losses every day. The accumulation of 0% and 1% days explain much of the positive S&P 500 annualized total return from March 31, 2003 to December 31, 2024.

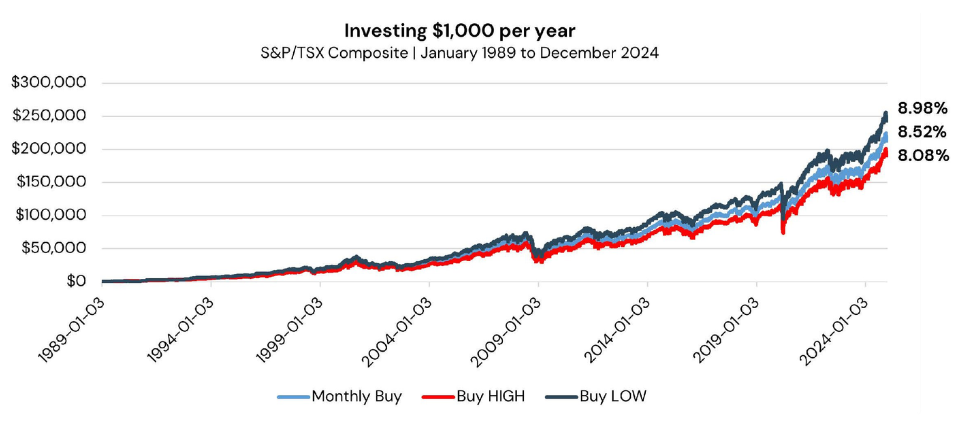

Market Timing in the Long Run4

Consider an investor blessed with the power of perfect market timing (dark blue line) compared to another investor cursed with systematically picking the worst possible day to invest each year (red line). In the end, the difference is a little less than 1%, and when considering an investor saving systematically at the beginning of each month, the annual outperformance shrinks below 0.5%.

Cycle of Investing Emotions5

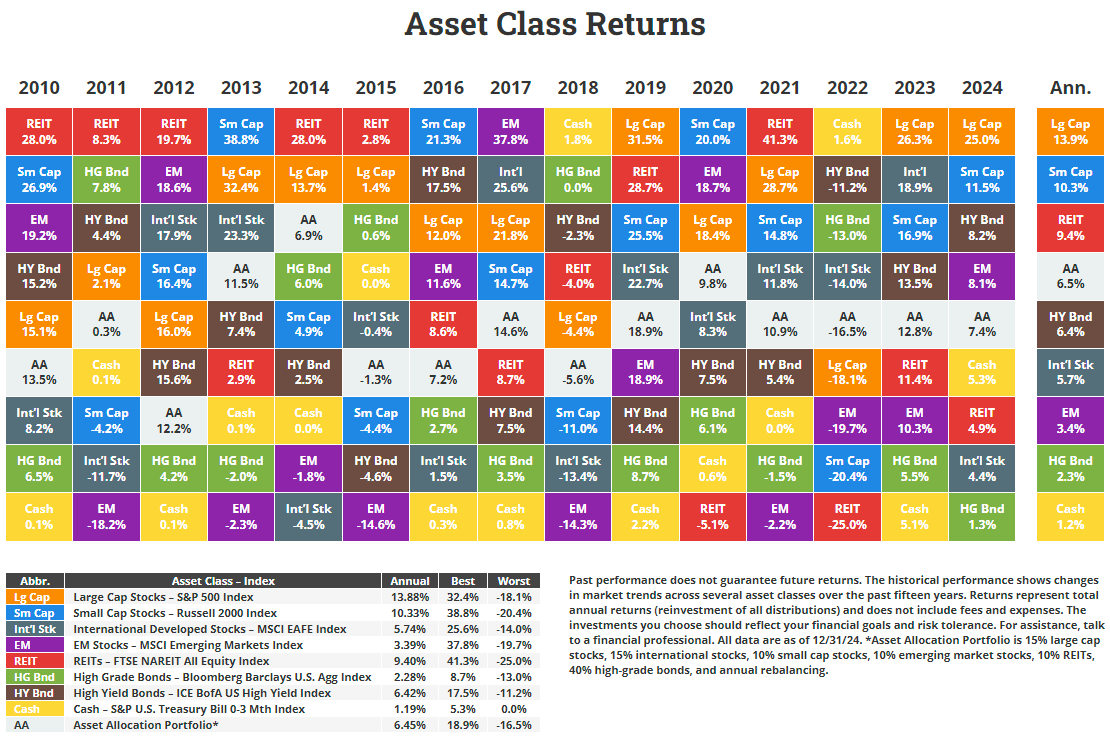

Asset Class Returns6

This chart below shows annual returns for selected asset classes over the past 15 years, demonstrating how market trends differ year to year. This investment performance quilt serves to illustrate that investing across a variety of asset classes may help to mitigate risk.

Source: NovelInvestor.com

Source: NovelInvestor.com

Ending Thoughts

At Alitis, we rely on analysis, experience, and the lessons of market history to guide the direction of our portfolios. We place a strong emphasis on diversification as a crucial factor for a smoother investing experience. We firmly believe in spreading investments across various asset classes, such as equities, fixed income, real estate, and alternative investments, to lower exposure to market volatility, provide opportunities for higher returns, and minimize the impact of any single investment on overall returns.

Our Portfolio Managers will take the time to understand your situation, family, and risk profile. We will take this information to guide you to remove emotions from the equation and help you focus on your long-term goals.

Our strong client relationships and transparent approach coupled with our investment philosophy and process result in a customized experience that clearly demonstrates the value we add as Portfolio Managers for our clients.

Our Team at Alitis

Our dedicated team at Alitis has over 250 years of collective industry experience. But what makes us unique is the high level of integrity that every team member brings to the table.

Along with experience and integrity, each team member at Alitis shares the same commitment to our clients. At the end of the day, we measure our success based on the success of you reaching your financial goals.

If you’re interested in investing with Alitis, let’s have a conversation:

Disclaimers and Disclosures

- Russell Investments Group. (2024, June). 2024 – Value of an Advisor. Russell Investments. Retrieved February 11, 2025, from https://russelinvestments.com/-/media/files/ca/en-secure/research-and-commentary/value_of_advisor.pdf

- The Canadian Press. (2020, April 22). ETF, mutual fund assets took 10% hit in March. BNN. Retrieved October 17, 2022, from https://www.bnnbloomberg.ca/investing/2020/04/22/etf-mutual-fund-assets-took-10-hit-in-march/

- Bloomberg L.P. S&P 500 Total Return Index in USD. 2003/03/31 to 2024/12/31. Bloomberg Terminal, 15 January 2025.

- Bloomberg L.P. TSX Total Return Index in USD. 1989/01/03 to 2024/12/31. Bloomberg Terminal, 15 January 2025.

- “Don’t Let Emotions Control Your Investments.” Co-Operators, https://www.cooperators.ca/en/Resources/plan-ahead/emotions-and-investing.aspx.

- “Annual Asset Class Returns.” Novel Investor, 14 January 2025, https://novelinvestor.com/asset-class-returns/. Returns shown in USD.