2025 Tax Rates – British Columbia

Key updates on tax brackets, CPP, RRSP and TFSA limits, and more.

As British Columbia (BC) welcomes 2025, several key updates to the province’s tax system are set to impact residents, businesses, and families alike. BC continues to use a progressive income tax system. While the tax rates themselves remain the same for 2025, the income thresholds have been adjusted for inflation to reflect the rising cost of living. The inflation rate is 2.7 per cent in 2025 compared to 4.7 per cent in 2024.1

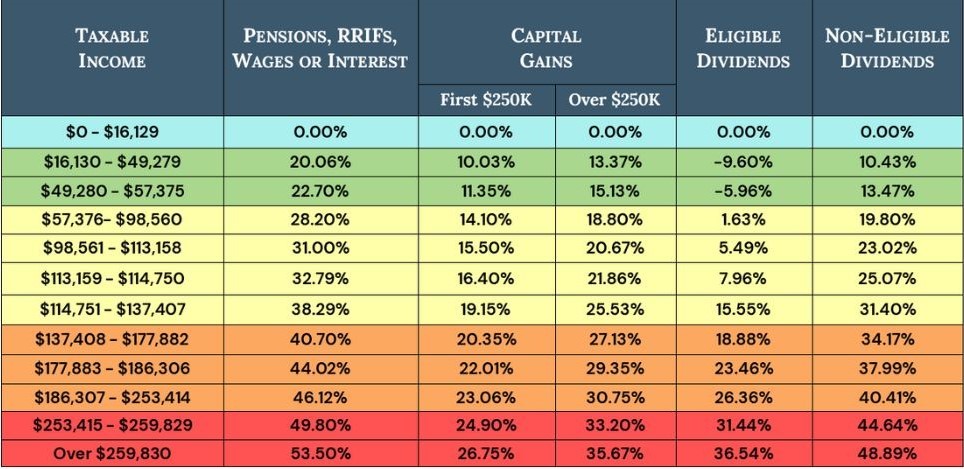

The table below shows the 2025 combined federal and provincial marginal tax rates for various types of income.

Here are some of the key changes for 2025:

Basic personal amount (BPA): The BPA is the amount of income an individual can earn without paying any tax. Federally, this amount increased from $15,705 to $16,129 and from $12,580 to $12,932 provincially.

CPP contributions: The Canada Pension Plan contribution rate will remain at 5.95% based on the new Yearly Maximum Pensionable Earnings (YMPE) of $71,300. In 2024, a second earnings ceiling was introduced, the Year’s Additional Maximum Pensionable Earnings (YAMPE). The YAMPE is used to determine second additional Canada Pension Plan contributions (CPP2). The 2025 YAMPE will be $81,200 – up from $73,000 in 2024. The YAMPE will be approximately 14% above the YMPE from 2025 onwards.

RRSP dollar limit: The registered retirement savings plan dollar limit for 2025 is $32,490 up from $31,560 in 2024. Note that the amount you can contribute to your RRSP is limited to 18% of your 2024 earned income.

TFSA limit: In 2025, the annual limit is $7,000, for a total of $102,000 for someone who has never contributed and has been eligible for the TFSA since its introduction in 2009.

Capital Gains Inclusion Rate2: The CRA is administering the proposed capital gains inclusion rate legislation.

Please view our BC Tax Rates handout for a more comprehensive list of tax information for 2025.

Need Help Optimizing Your Investment Taxes in BC?

Navigating tax changes can be complex, but our portfolio managers are here to help. Whether you’re seeking clarity on how these tax changes may impact your investments, retirement plans or overall financial goals, our team is equipped to provide personalized guidance. If you have any questions or concerns, please reach out to us anytime. Let our team help you to optimize your investment earnings and its effect on your taxes in British Columbia.

Disclaimers and Disclosures

Alitis Investment Counsel Inc. and its affiliates do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before finalizing your tax returns.