Real Estate Resiliency

During this unprecedented time, I want to wish you and your families well as the world collectively deals with the COVID-19 virus. The speed in which the COVID-19 virus has wreaked havoc on the Canadian and global economies as well as equity markets is unprecedented. It will take time for the economy to restart and border to reopen but we will all get through this together.

Overall, there has been a concerted global effort to contain the spread of the COVID-19 virus. However, the measures taken have been extremely painful in the short-term as they have delivered a direct and immediate hit to the economy. The good news is that central banks and governments have been proactive in trying to support their economies through both monetary (interest rate cuts and quantitative easing) and fiscal policy (stimulus spending including support for families and employers). The United States, Canada, Japan and Germany have all announced stimulus packages that amount to around 10%¹ of GDP. In Canada, the Bank of Canada has cut interest rates by 1.50% with the overnight rate now at 0.25%.

These measures have provided some support to global equity markets over the past couple of weeks, but the number of COVID-19 cases is still expected to rise significantly over the coming days, weeks and months; volatility will remain heightened. There has been a lot of talk about the impact of the COVID-19 crisis on equity markets and we have endeavored to keep you up to date on the direct impact to you, but you may be wondering how has all of this affected your real estate investments?

There are four Alitis mandates: the Alitis Growth Pool (Growth), Income & Growth Pool (I&G), Private REIT (REIT) and Private Real Estate Limited Partnership (RELP) that have investments in real estate. The Alitis Growth Pool has a 22.5% real estate allocation while the Alitis Income & Growth Pool has a 26.5% allocation. Excluding cash, both the REIT and RELP are fully invested in real estate. Across all mandates, we are almost exclusively invested in residential investments. Residential includes multi-family rental apartments as well as “for sale” townhomes and condominiums. These real estate investments also range from being fully stabilized (income producing) to those still in the pre-construction (re-zoning & permitting) phase. The COVID-19 virus has impacted each differently, and I would like to discuss four impacts in particular:

- Tenants requesting rent deferrals

- Rental buildings having higher vacancies

- Real estate values changing due to changes in capitalization rates (cap rates)

- Projects taking longer to sell

Rent Deferrals

With many businesses effectively closing their doors for several weeks, there have been mass layoffs in many different sectors and regions. These layoffs or reduction in hours are expected to create an increase in rent deferral requests, especially since it will take time for cash to be received from new government benefits such as the Canada Emergency Response Benefit (CERB). These rent deferrals will reduce cash-flow and thus returns in the short-term. Currently, we have two core-plus investments and one value-add investment that could be impacted by rent deferrals.

- Ironclad Developments Pembina LP (Pembina). Pembina is a partially complete 282-unit rental apartment in Winnipeg, MB with 115 units rented. So far, Ironclad has received zero requests for rent assistance.

- RISE Properties Trust (Rise). Rise is a portfolio of rental apartments in Greater Seattle, WA totaling over 4,000 units. Less than 5% of tenants have made requests to defer rents.

- Starlight Canadian Residential Growth Fund (Starlight). Starlight is a portfolio of 5,734 rental units in Ontario and British Columbia. As of last week, they had not received any rent deferral requests but that is likely to change.

It is important to note that a deferral is not a rent forgiveness. Tenants will be required to pay back their rent over a certain period of time which will be agreed upon on a case by case basis. Some tenants may not be able to pay their rent even after they return to work, so we are modeling higher vacancies and bad debts over the coming months.

Higher Vacancies

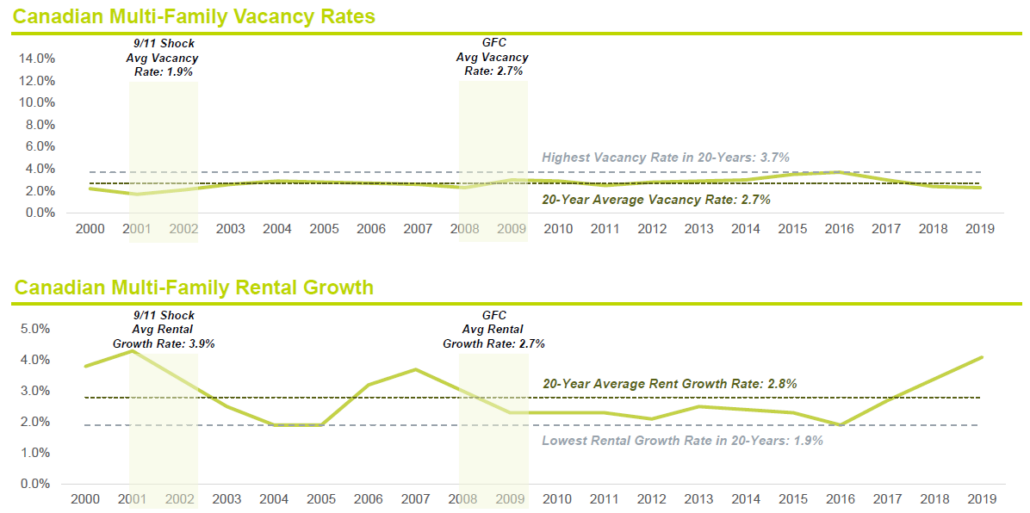

When we look back over the past 20 years, it is encouraging to see that vacancy rates for Canadian multi-family residential real estate peaked in late 2015 at 3.7%, see chart below. The highest multi-family vacancy rate in the past 50 years was 4.8%, which was reached in 1992. Shelter is a basic need and individuals and families will cut back on discretionary spending or take on more personal debt before they miss a rent or mortgage payment.

Cap Rates

The biggest impact to our real estate investments could come from a broad change in the value of rental apartments. Rental apartments are generally valued based on the amount of net operating income (NOI) they generate, divided by a cap rate. The cap rate is the rate of return an investor would earn on owning the property for a year assuming the property was purchased with cash and there was no change to income and expenses. As cap rates decrease, the value of real estate increases, and vice versa.

Canadian multi-family capitalization rates vary from 2.50%² (Vancouver A quality properties) to over 7.00%² in secondary markets for B quality properties. A building that generates $500,000 of NOI would have a value of $10 million assuming a 5.0% capitalization rate ($500,000 / 5% = $10,000,000). Most of the properties in which Alitis is invested have capitalization rates ranging from 4.25% – 5.25%.

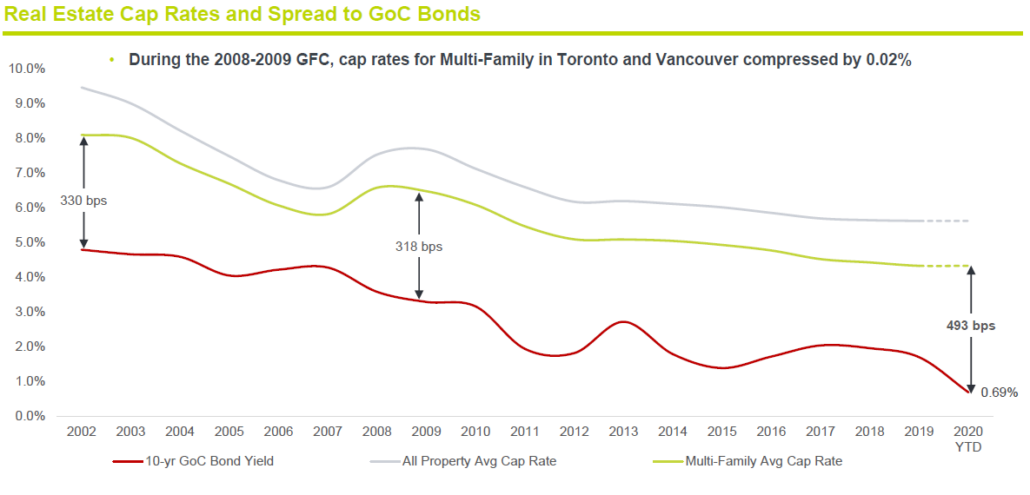

There are many factors that affect capitalization rates including availability of capital including credit (demand), new construction (supply), interest rates, as well as inflation. Heading into the global financial crisis (GFC) the spread between the 10-year Government of Canada Bond and the cap rate was a little more than 2.0% while today stands at 4.93%¹, the widest it has been in over 20 years. We view this spread as a buffer to possible cap rate increases as we believe this spread would have to compress significantly before cap rates moved up. This should help to support multi-family real estate values over the near term.

For the most part, COVID-19 has caused prospective buyers and sellers to pause as they wait to see how the crisis unfolds. In looking back at the most recent recession, the GFC, cap rates for rental apartments expanded by 0.55%³ from Q1/08 to Q1/09, indicating a decline in property values. However, property values recovered quickly. Proceeding on the side of caution, Alitis has elected to make small increases to the capitalization rates used in our valuations, as we believe it will take time for cap rate to adjust in the market. Despite these adjustments, the Alitis Private REIT posted a modest gain in March of 0.17%, thanks to construction progress on our opportunistic developments.

Longer Selling Times

A smaller percentage of our investments is in the development of “for sale” townhomes and condominiums in Metro Vancouver. The current stage of the projects varies significantly from early stage pre-construction (zoning) to projects currently under construction and projects that have completed construction and are actively selling.

The Vancouver real estate market was extremely hot to start the year, with sales volumes up approximately 45%4 year-over-year and broad price increases. The impact of COVID-19 has affected each project differently. For projects that are currently selling, there has been no immediate adjustment to the selling prices. However, sales are expected to slow significantly over the coming 60-days as open houses are cancelled and Alitis’ development partners transition to only selling via private appointments.

With slower than expected absorption, project profitability has been impacted as financing costs need to be carried for a longer period of time. Again, erring on the side of caution, for projects that will begin selling later this year, expected selling prices have been decreased. Overall, construction continues to progress as sites remain open and active. Progress within our allocation to construction properties has for the most part, offset a decrease in overall expected profits.

Closing/Summary

Overall, Alitis’ real estate assets remain in very good shape and we don’t expect a material impact to the value of our private real estate investments. If the crisis persists far longer than anticipated, real estate could experience broader declines in value. Over the short-term, the REIT will hold a higher than usual cash balance which will be used to capitalize on investment opportunities that will inevitably arise. Additionally, I will look to take a small position in publicly listed REITs as they are trading at discounts to their net asset value.

The impact of COVID-19 on our projects will depend on the length and severity of the crisis, but we are optimistic that the social distancing measures and site safety measures that have been imposed will have the intended impact of flattening the curve.

Sincerely,

Mitchell Prothman, CFA, CFP

Senior Portfolio Manager & Head of Trading

Disclaimers and Disclosures

- Starlight Investments – “Multi-Family resiliency”, April 1, 2020

- CBRE – Q4 2019 Canadian Cap Rates & Investment Insights

- BMO – “Re-calibrating to reflect double whammy of Coronavirus pandemic and oil shock”, March 13, 2020

- Real Estate Board of Greater Vancouver – February and March 2020 monthly reports

Core real estate is considered to be the least risky because they often target stabilized, fully leased, secure investments in major core markets. Core Plus real estate, is similar to Core, but not quite as high quality as the property might be in the suburbs or a secondary metropolitan area, the tenants may not be quite as high quality, or it may involve a property type that is not one of the four main property types. A newly-built property may also be classified as Core Plus if the leverage is in the 40% to 70% range. Value Added real estate investments typically target properties that have in-place cash flow but seek to increase that cash flow over time by making improvements to or repositioning the property. Opportunistic strategies involve the development of raw land into residential or commercial properties. It may also involve the conversion of properties or target highly distressed properties that require major renovations.

Unless otherwise noted, the indicated rates of return are the historical annual compounded returns for the period indicated, including changes in security value and the reinvestment of all distributions and do not take into account income taxes payable by any securityholder that would have reduced returns. The investments are not guaranteed; their values change frequently and past performance may not be repeated. Unless otherwise noted, risk refers to the annualized standard deviation of returns for the period indicated.