Alitis Income & Growth Pool is outperforming all Canadian funds in its category

How alternative investments may offer better performance and reduced risk for investors

Alitis Investment Counsel was recently featured in the Campbell River Mirror and Comox Valley Record. Read more below:

The view behind Alitis’ Campbell River office

Vancouver Island’s Alitis Investment Counsel began in the midst of the financial crisis in 2009, when founders Cecil Baldry-White and Kevin Kirkwood developed a new investment strategy to help their clients survive future market fluctuations. A decade later, their philosophy has faced a real test with 2020-2022’s volatility — and proving very effective.

The Alitis Income & Growth Pool is currently number one in Canada in its category (Global Neutral Balanced), meaning it has out-performed all other similar mutual funds year-to-date (as of August 31, 2022).

“I often check Fundata.com to see how our investments are performing compared to others. Right now, there are only a handful of balanced funds in Canada that have made money this year — thousands of others are ‘in the red’. That speaks to what kind of year it’s been, and it also shows that our investment philosophy is paying off.”

Alternative investments offer added diversification

The secret to success at Alitis is diversification. Not just a diverse selection of stocks and bonds, but also a meaningful allocation to alternative investments, including private real estate, private mortgages, private debt, private equity and hedge funds.

“Both stocks and bonds have been beaten up badly this year, which is why our Income & Growth Pool also invests in private assets. Private real estate and private mortgages, in particular, have held up quite well in the current market,” Kirkwood says. “By pooling our clients’ money together, we’re able to qualify for some high calibre investments that are typically only available to the ultra-wealthy.”

Among Alitis’ seven investment offerings, the Alitis Income & Growth Pool has the most fund assets and is its most diversified offering.

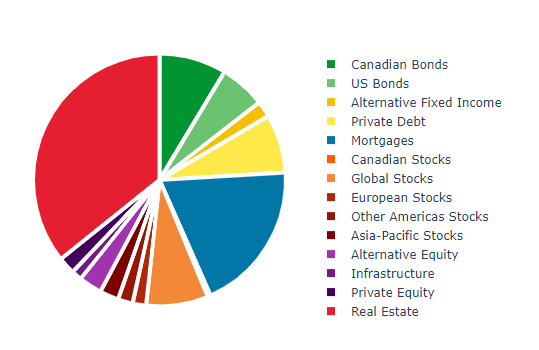

Asset allocation for the Alitis Income & Growth Pool (Aug 2022)

“Our vision is to enrich the lives of investors by providing access to financial opportunities that are typically reserved for the ultra-wealthy, and following that vision is what’s allowed this fund to be successful.”

The math surrounding investments changes on a daily basis as inflation, geopolitical events and other factors influence global markets, which is why the professionals at Alitis continuously monitor and rebalance funds. The small firm boasts an impressive number of people who hold the Chartered Financial Analyst designation — a designation that takes years of study and experience to achieve — and it’s that expertise that has brought Alitis clients solid results.

Find Alitis Investment Counsel at these three locations:

- Campbell River at 101-909 Island Highway,

- Victoria at 1480 Fort St.,

- Comox Valley at 103-695 Aspen Rd. starting in October 2022.

Our Clients are Our Focus

At Alitis, we take pride in investing similar to a pension fund, yet catering to the everyday investor. That means our clients can rest easier knowing our risk-mitigating approach will be with them long term – regardless of how markets are performing.

We’ve developed a deep level of trust with our clients, because over the past 12 years, we’ve delivered on what we promised them – solid returns and less volatility. Our high client retention rate speaks for itself and we work to help ensure that our clients do not need to worry about the next stock market fluctuation that could throw their financial future into question.

Our Team at Alitis

Our dedicated team at Alitis has over 250 years of collective industry experience. But what makes us unique is the high level of integrity that every team member brings to the table.

Along with experience and integrity, each team member at Alitis shares the same commitment to our clients. At the end of the day, we measure our success based on the success of you reaching your financial goals.

If you’re interested in investing with Alitis, let’s have a conversation: