Maximizing Your Business Sale: Insights from Industry Experts

In a recent virtual event collaboration by Chinook Business Advisory Inc., Alitis Investment Counsel, Chan Nowosad Boates Chartered Accountants and RLR Lawyers, experts from each firm delved into critical strategies for maximizing the proceeds of a business sale. From financial planning to tax implications, the discussions offered valuable insights tailored to business owners preparing for this significant transition.

This article is derived from a transcript taken during the above-mentioned virtual event discussing the topic of Maximizing Your Exit Strategy when transitioning out of business ownership. This discussion was hosted by Breanne Epoch, Director of Marketing at Chinook Business Advisory Ltd. on June 12, 2024.

In this article transcript, you will learn about the following concepts and strategies.

- How to determine what is being sold (shares vs assets)

- Timing the sale (short, medium, or long term)

- Understanding the reasons for selling (e.g. retirement)

- Exploring methods of sale (all at once, earn-out, vendor financing, etc.)

- Financial security and income sources, post-sale

- Mental preparation for the loss of control over the business

- Exploring alternative investments

- The benefits of working with a full-service brokerage

- How you can be supported through the entire sales process

- 10 legal questions commonly asked during this type of event

- The importance of integrating accounting, financial, and legal advice

Navigating the Sale of Your Business

The discussion began with Ramon Ramirez, Partner and Business Intermediary at Chinook Business Advisory Inc., highlighting the importance of preparation in selling a business. He stated that only about 1 in 10 business owners develop a formal plan in place and introduced “Getting to the Finish Line”, a resourceful book authored by his colleagues Keith MacKenzie and Mike Lenz, available for free to interested business owners seeking guidance on navigating the sale process. Ramirez emphasized the book’s relevance in addressing common challenges and strategies associated with business exits.

The Importance of Confidentiality

Ramirez emphasized the paramount importance of confidentiality in any business sale process. “Nothing good comes from people knowing that the business is for sale,” he stated. Keeping employees, competitors, clients, and even family members unaware of the impending sale helps maintain stability and avoid disruptions.

Market Trends and Opportunities

Highlighting current market dynamics, Ramirez pointed out a significant trend: the impending wave of baby boomer retirements, which is expected to affect a substantial portion of Canadian businesses. Despite this, Ramirez noted that only a fraction of business owners have formal succession plans in place, presenting both challenges and opportunities for prepared sellers and prospective buyers alike.

Challenges in Selling a Business

Ramirez outlined several obstacles commonly faced when selling a business. These include finding suitable buyers, accurately determining the business’s value, and mitigating risks associated with over-reliance on the owner for operations — a factor that can impact business continuity.

Impact of External Factors

Discussing the broader economic landscape, Ramirez acknowledged the dual impact of COVID-19 and economic fluctuations on business exits. He cited statistics indicating fluctuating sales figures and varied purchase prices influenced largely by shifts in interest rates and inflation.

The Process of Selling a Business

Detailing the structured process of selling a business, Ramirez highlighted key steps:

- Preparation: Understanding reasons for sale, preparing the business, and collecting necessary documentation.

- Marketing: Developing a strategic marketing plan tailored to attract potential buyers while maintaining confidentiality.

- Negotiation: Entertaining offers, conducting due diligence, and finalizing sale transactions.

Valuation Methods

Ramirez explained three primary approaches to valuing a business: market-based, income-based, and asset-based. The market-based approach, which uses comparable sales data, is the most commonly employed, providing a benchmark multiplier based on revenue or earnings. Income-based valuation focuses on projected future earnings, while asset-based valuation assesses the total value of assets minus liabilities, suitable for asset-heavy industries.

Strategies to Enhance Business Value

Addressing common seller concerns, Ramirez advised on strategies to enhance business value and marketability. These include improving profitability, minimizing inventory risks, and reducing dependency on single suppliers or clients. Additionally, maintaining transparent financial records and assembling a proficient advisory team comprising of lawyers, accountants, and wealth advisors were highlighted as critical preparatory measures.

Emotional and Financial Preparedness

Ramirez acknowledged the emotional toll of selling a business and offered practical advice on staying focused, communicating clearly, and maintaining professionalism throughout the process. Financial preparedness, including understanding post-sale financial needs and potential lifestyle adjustments, was also stressed as crucial for a smooth transition.

In conclusion, Ramirez underscored the comprehensive nature of preparing and executing a successful business sale. He offered practical insights and resources, including a complimentary book, “Getting to the Finish Line,” aimed at guiding business owners through the complexities of selling their businesses. People can email info@chinokmabb.com to request a complimentary copy of the book and to learn more.

Strategic Financial Management

Following Ramirez’s presentation, Sean Fetter, Associate Portfolio Manager at Alitis Investment Counsel, shared insights on financial strategies aimed at maximizing the value of business sales. Fetter stressed the complexity of financial planning, advocating for a comprehensive approach that involves hiring diverse talent and collaborating with experienced professionals. He highlighted the significance of early engagement with portfolio managers and financial planners to align personal and business goals with long-term wealth management strategies.

Addressing Financial Concerns

Fetter further discussed common concerns among business owners contemplating a sale, such as post-sale financial security, income streams, and integration of proceeds with other investments like real estate and retirement savings. He emphasized the role of financial planning in providing clarity and reassurance during critical transitions, ensuring business owners are well-prepared for the financial implications of selling their largest asset.

Expert Insights on Investment Strategies

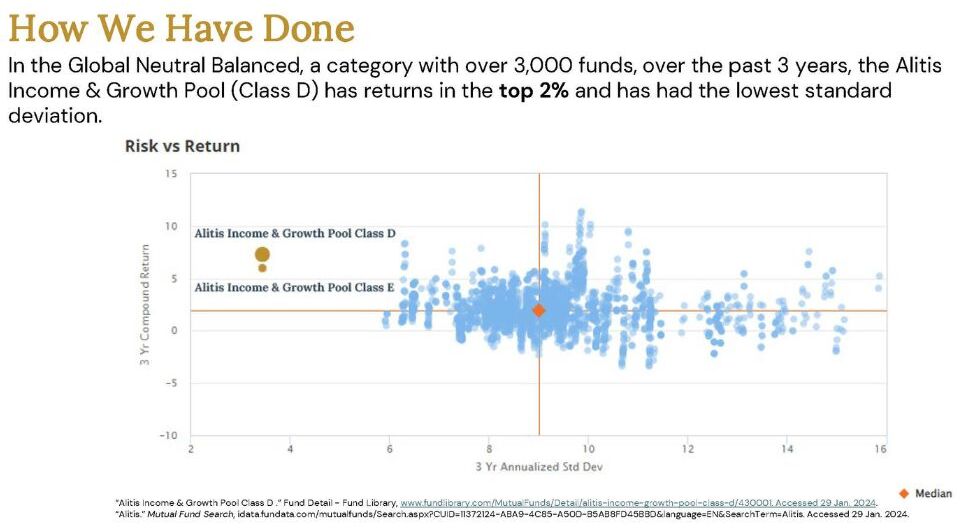

Illustrating the importance of diversified investment portfolios, Fetter presented Alitis Investment Counsel’s approach, which integrates traditional and alternative asset classes. Real assets, private mortgages, alternative equity, alternative fixed income, and private debt are considered alternative investments, as are any asset classes that aren’t stocks, bonds, or cash. Alternative investments can be a powerful tool to help investors achieve growth, reduced volatility, and diversification. Fetter highlighted the Alitis Income & Growth Pool as an example of a balanced fund designed to mitigate volatility and optimize returns, particularly beneficial post-business sales when stability is paramount.

For more information on the Alitis Income & Growth Pool, please visit: Alitis Income and Growth Pool – Alitis Investment Counsel

Fetter’s presentation underscored the intricate nature of financial planning for business sales, emphasizing the necessity of early and comprehensive engagement with skilled professionals. By addressing common concerns and showcasing diversified investment strategies, Fetter provided valuable insights into achieving financial security and growth post-sale. If you are interested in learning more, please call 1.800.667.2554 or connect by email at sfetter@alitis.ca.

Tax Planning Considerations

Tom Miller, CPA at Chan Nowosad Boates, provided an in-depth exploration of tax considerations in business sales. Miller differentiated between asset sales and share sales, outlining the respective tax implications and strategic planning opportunities for minimizing tax burdens. He underscored the necessity of early tax planning to maximize after-tax proceeds, emphasizing the value of consulting with tax experts well in advance of initiating a business sale.

The tax basis of the assets being purchased plays a critical role in determining the tax implications of a sale.

Asset Sale Overview

An asset sale typically involves the sale of corporate assets to a third party. These assets can include equipment used in the business, land and buildings, shop property, existing contracts, and imputed goodwill. Goodwill represents the value generated by the business’s reputation and customer base, which a buyer may pay for when purchasing the business.

Corporate Tax Implications

When selling assets from a corporation, two significant tax implications arise at the corporate level:

- Capital Gain: If the assets are sold for more than their purchase price, a capital gain is realized.

- Depreciation Recapture: Over time, tax depreciation may have been claimed on the assets, reducing their tax basis. If the assets are sold for more than this reduced tax basis, the depreciation claimed may need to be recaptured and included in income, resulting in additional taxes.

Changes in Capital Gains Inclusion Rate

Recent legislative changes have impacted the capital gains inclusion rate. Effective June 25, 2024, the rate will increase from 50% to 66.67%. For individuals, a $250,000 annual threshold for capital gains will still be taxed at a lower rate, but corporations will not have this threshold, leading to higher corporate taxes and less tax-free money for shareholders.

Taxation of Corporate Capital Gains

When a company sells its goodwill and business assets, there are two levels of tax to consider:

- Non-Refundable Tax: Approximately 20% of the taxable portion of the capital gain.

- Refundable Tax: A higher tax rate of 30.67% on capital gains, which can be refunded if sufficient dividends are paid out to shareholders. This policy discourages passive income accumulation within corporations by taxing capital gains at a high rate but allowing refunds through dividend payments.

Planning for Corporate Taxation

Maximizing dividends in a single year to avoid refundable tax is often not advisable, as it may result in higher personal taxes. A common strategy is to pay some refundable tax upfront and then plan dividend payments over several years to minimize overall tax liability.

Indirect Taxes

In addition to income tax, the sale of business assets may be subject to indirect taxes such as GST and PST. It’s essential to be aware of these taxes and consider filing a GST 44 election to avoid GST collection and remittance.

Selling Shares and Lifetime Capital Gains Exemption

Selling shares instead of assets can be more tax-efficient due to the lifetime capital gains exemption, which exempts a certain amount of capital gain from tax. For 2024, this exemption exceeds $1 million and will increase to $1.25 million for dispositions after June 25, 2024.

Qualifications for the Lifetime Capital Gains Exemption

To utilize the lifetime capital gains exemption, the following conditions must be met:

- The corporation must be a small business corporation at the time of sale.

- The shares must have been owned for at least 24 months before the sale.

- More than 50% of the business assets’ fair market value must have been used in active operations during the 24 months before the sale.

If these conditions are not met, the full capital gain may be subject to tax.

Small Business Corporation Test

A small business corporation must have 90% of its business assets used in active operations at the time of sale. Passive assets, such as investment portfolios, GICs, rental properties, and excess cash, can disqualify the corporation from the exemption if they exceed allowable limits.

Alternative Minimum Tax (AMT)

While the lifetime capital gains exemption can significantly reduce tax liability, business owners should be aware of the alternative minimum tax (AMT), which ensures a minimum level of tax is paid. AMT is recoverable up to seven years after the sale, but it may still impact immediate tax expectations.

Planning Techniques

Several planning techniques can help optimize tax outcomes:

- Purification: Removing excess passive assets from the corporation before a sale to qualify for the lifetime capital gains exemption.

- Vendor Financing: Spreading capital gains over a maximum of five years if sale proceeds are not received all at once, reducing immediate tax liability.

- Cost Analysis: Comparing after-tax cash flow between selling shares and assets to determine the most tax-efficient strategy. Negotiations with buyers may help shift the preference to share sales if tax savings are substantial.

By understanding these tax implications and employing strategic planning, business owners can effectively manage the tax impact of selling their business assets or shares.

It was made ultimately clear not to underestimate the multifaceted nature of preparing for a business sale, from initial contemplation through to post-sale financial management. Participants were encouraged to adopt a proactive approach, leveraging expert advice and collaborative partnerships to optimize outcomes and secure financial stability.

Strategic Planning and Consultation

Navigating the complexities of business sales and tax implications requires careful planning and consultation with experienced professionals, including tax advisors and legal counsel. Developing a strategic approach tailored to your specific business circumstances can optimize your tax position and financial outcomes.

Whether you opt for an asset sale or a share sale, understanding the tax implications is critical for making informed decisions that align with your financial goals. By leveraging tax-efficient strategies and seeking expert advice, business owners can minimize tax liabilities and maximize after-tax proceeds from the sale of their businesses.

While the decision to sell your business may be multifaceted, addressing tax implications early in the process can help mitigate risks and optimize financial outcomes for all parties involved. It provides insights into recent tax changes, the benefits of the Lifetime Capital Gains Exemption, and strategic planning considerations for business owners.

From the perspective of the law

The next presenter was Paul R. Ives of Ramsay Lampman Rhodes, otherwise known as RLR Lawyers. Paul presented the top 10 questions that their firm receives from business owners planning the sale of their business. These questions will shed light on the intricate details involved in business transitions and will cover various aspects from internal succession to external sales and beyond.

Who Are You Selling to

- Internal individuals: Consider a transitional buyout of the business while maintaining control over a longer period. This provides buyer equity participation and an ownership stake until the majority interest is acquired.

- Family Member: This will require estate planning and financial planning, but it is also important to consider working capital and confidentiality.

In internal succession planning scenarios where family members or key employees take over the reins of a business, it’s incredibly important to maintain meticulous planning to ensure a smooth transition of ownership while preserving business continuity. Legal expertise in wills and estate planning is crucial for navigating the complexities of family business transfers.

When Considering External Sales

When considering external sales, confidentiality is a cornerstone requirement, ensuring that sensitive information remains protected throughout the negotiation process. The importance of early preparation, including up-to-date accounting records and comprehensive legal documentation, was underscored to mitigate risks and maximize transactional efficiency.

What Is Being Sold: Assets vs Shares

As noted in an earlier discussion, this distinction holds significant implications for tax planning, liability assumption, and ongoing obligations to stakeholders such as employees, landlords, and suppliers. A clear declaration of included and excluded assets, alongside careful consideration of shareholder loans and preferred shares, emerged as pivotal in structuring successful deals.

Legal and Financial Safeguards: Ensuring Long-Term Security

Paul emphasized legal safeguards such as non-compete agreements and post-closing consulting arrangements. These measures aim to protect business goodwill and continuity while managing potential risks arising from employee transitions and contractual obligations.

Beyond the Sale: Planning for the Future

Paul concluded with a forward-looking perspective on post-sale responsibilities. He also stressed the importance of ongoing support to new owners, vendor financing arrangements, and potential earnout structures. Addressing tax implications and compliance with regulatory requirements post-sale remains critical to avoid pitfalls and ensure sustainable business growth.

Paul offered invaluable insights into the intricate world of business transitions. From internal succession planning to external sales negotiations, the legal experts at Paul’s firm provided a roadmap for navigating these complex processes with confidence and clarity. As businesses contemplate their future, such guidance proves indispensable in ensuring informed decisions and sustainable outcomes.

For those interested in exploring these topics further or seeking personalized legal counsel, Paul’s firm stands ready to assist, leveraging their expertise and commitment to client success in every aspect of business transition planning.

Summary

There are many things to consider when you are planning on selling your business. It is recommended to start early and work with a team of professionals so that you can maximize your exit strategy.