Learnings from A Random Walk Down Wall Street by Burton G. Malkiel

As the ongoing pandemic has restricted everyone’s ability to travel and explore, I have found a way to escape through the next best alternative: books. I recently finished reading one of the most classic investment books: A Random Walk Down Wall Street. The first edition of this book was published over forty-five years ago and the book has truly stood the test of time. The lessons from this book are still very relevant and there are some true merits to the author’s overall investment recommendations. Below are my most valuable takeaways from this book:

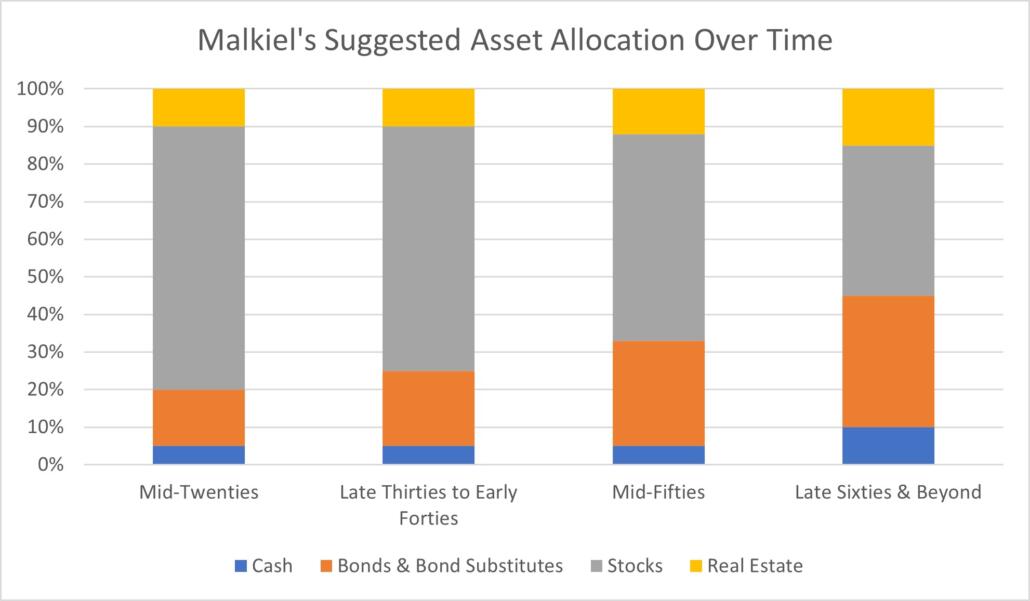

1. Importance of diversification beyond stocks and bonds at all age groups

Beyond traditional stocks and bonds, the author emphasizes the importance of bond substitutes/alternatives and real estate investing {through real estate investment trusts (REIT)} for investors across different age groups.

We at Alitis strongly believe in this philosophy: the Alitis Private Mortgage Fund is a bond substitute designed to generate a high level of income with relatively low volatility. In today’s low-interest-rate environment, the Private Mortgage Fund targets net annualized returns in the 6-7% range while the Canadian 10-year government bond is presently yielding less than 1.6% (https://www.bankofcanada.ca/rates/interest-rates/canadian-bonds/). Similarly, the Alitis Private REIT offers access to private real estate investments with a focus on the multi-family residential sector. The Private REIT fund targets net annualized returns of 7%-10%. It is Alitis’ view that diversification across many different asset classes will mitigate risk which is an important factor in building a well-balanced investment portfolio across all age groups.

2. Stock Picking vs. Indexing

In today’s low fees/zero fees environment, anyone who has access to the internet and watches BNN news can become a stock picker. But time and again, index-based investment strategies have outperformed active managers. Based on S&P Global’s SPIVA (“S&P Indices Versus Active”) Statistics & Reports (https://www.spglobal.com/spdji/en/spiva/#/reports ) as of Dec 31st, 2020, 98.63% of Canadian equity funds underperformed the S&P TSX Composite index over the previous five years. Another factor to keep in mind while considering stock picking and trading in and out is the fees associated with each transaction; these costs add up over time and can have a material impact on your portfolio’s performance.

We at Alitis believe that the market finds its true intrinsic value, so you will never hear our portfolio managers & advisers talk about things like the top stock pick of the hour. We believe in hedging our bets and complementing our active portfolio management in the alternative space (mortgages, private debt, real estate, private equity) and traditional asset classes (stocks & bonds) with low-cost passive investment strategies. It is Alitis’ view that this creates a complimentary mix of active and passive investment strategies.

History has indicated that it is almost impossible to beat the market by timing the market. The safest and most efficient way to build wealth is through time. Portfolios will go up in the long run because the expected returns of the investments are positive, or otherwise they would not be able to attract capital. Combined with the compounding effect, a well-diversified portfolio held for long periods should produce generous results.

3. Behavioral biases and their side effects

Individual investors are expected to be rational individuals who make decisions that maximize their wealth but are constrained by their risk tolerance. Below are some factors which indicate the irrational behaviour that investors may be prone to:

- Loss Aversion & Overconfidence: How often have you heard stories about a friend or a family member saying that they are holding on to a stock even though it has been performing poorly for five years, just because they believe it will recover? Well, that is because they do not want to admit that they are at fault – it is better to carry on that loss instead of realizing it because that makes it real, and one must admit their mistake. Another common manifestation of overconfidence is the consistent overvaluing of growth stocks.

- Herd Mentality: Of late everyone knows someone who got rich quickly with cryptocurrency investing. A couple of years ago, there was a similar buzz around marijuana stocks. We get lost in the herd mentality and get swept up with all the hype surrounding these get-rich-quick-trades and forget about our true risk tolerance and investment needs. People are quick to share success stories, but not failures, and what we do not hear about is all the failures that happened in these get-rich-quick-trades.

One of my all-time favourite movies is “Everest” directed by Baltasar Kormakur (released in 2015). There is a scene in the movie when a climber is talking with Rob Hall, the expedition leader, and is trying to push Rob to take some additional risks to make sure they can summit Mount Everest. Rob replies: “You do not pay me to take you to the summit; you pay me to bring you back safely.”

That is what our role as Portfolio Managers and Financial Advisors is: we are here to protect you from pitfalls, temptations, biases, and unnecessary risks and ensure your financial well-being is always paramount.

Thank You,

Apurva Parashar, MBA, CAIA, CIM ®

Associate Portfolio Manager

Alitis Investment Counsel Inc.

Buy the Book

If you would like to purchase a copy of Malkiel’s book, please follow this link to Amazon:

Disclaimers and Disclosures

Target returns are determined through a number of methods that are designed and intended to maintain the desired returns within the specified risk tolerance set for the fund. These methods vary. The fund manager has concluded that within the current environment displayed target returns are reasonable to expect over time, however, returns are not guaranteed. Talk with an Alitis representative to learn more about what determines the rate of return earned by the fund.