Alitis Income & Growth Pool: One of the Top Funds in Canada in 2022

At Alitis, we stay focused on our investment strategy and not worry about how everyone else is doing. Our diverse asset model and investment approach tends to perform well when traditional funds are struggling, so we thought it would be interesting to show you how our largest fund, the Alitis Income & Growth Pool, has fared relative to other balanced funds so far this year. We were very pleased with the results.

The foundation of our investment approach is to reduce risk by utilizing a variety of different of asset classes and alternative investments. The Alitis Income & Growth Pool utilizes all the asset classes and approaches available at Alitis, including stocks, bonds, private equity, private debt, real estate, mortgage investments, private infrastructure, and various hedging strategies.

This fund a good proxy for how well our approach is doing relative to other investments in Canada. Performance to the end of April for the Alitis Income & Growth Pool was:

| Year-to-Date | 1 Year | 3 Years | 5 Years | 10 Years | Since Inception | |

| Class D Units | 0.04% | 5.13% | 7.32% | 6.90% | 6.69% | 6.49% |

| Class E Units | -0.34% | 3.94% | 6.16% | 5.72% | 5.52% | 5.33% |

The Year-to-Date returns are particularly noteworthy. While these returns may not appear to be the greatest, compared to the broader investment landscape in Canada, these returns are extremely good! The Alitis Income & Growth Pool is categorized as “Global Neutral Balanced” and, according to Fundata Canada, there were 1470 funds (including different classes of the same fund) in this category with year-to-date returns. Within this category over this period, the Alitis Income & Growth Pool ranked as follows:

- Class D Units: #23 (Top 1%)

- Class E Units: #34 (Top 2%)

If we assess the fund against all the categories with “Balanced” in the name1, we find that there are 11,024 funds, with the Alitis Income & Growth Pool ranked as follows:

- Class D Units: #63 (Top 1%)

- Class E Units: #102 (Top 1%)

Obviously, it has been a challenge to generate positive returns in these unprecedented macroeconomic conditions since only 74 of those 11,024 balanced funds have had a positive return this year.

Inflation

Inflation and its impact throughout the economy is the primary concern in the financial world. This fear is likely heightened because many of us have never experienced inflation, as it has been muted for so long. The COVID lockdown,s accompanied by massive government stimulus to keep money in people’s hands created an environment where less was being produced while more money was flowing around. This excess money has led to demand exceeding supply, resulting in the current inflationary environment.

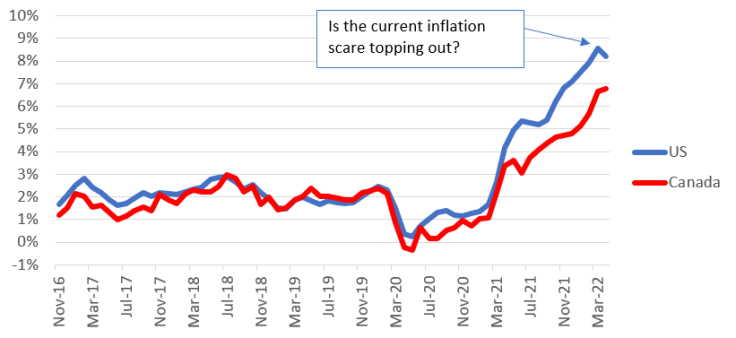

Inflation Rates Over the Last 5 Years (% change year over year)2

The current inflation rates for Canada and the US are substantially higher than they were before COVID which has led to significant turmoil in the stock and bond markets so far this year. Now, governments are starting to withdraw the COVID stimulus, and the economy is returning to normal so it is likely that the imbalances which caused this surge in inflation will fade away. Perhaps the recent decline in annual inflation in the US (see chart above) will mark the turning point.

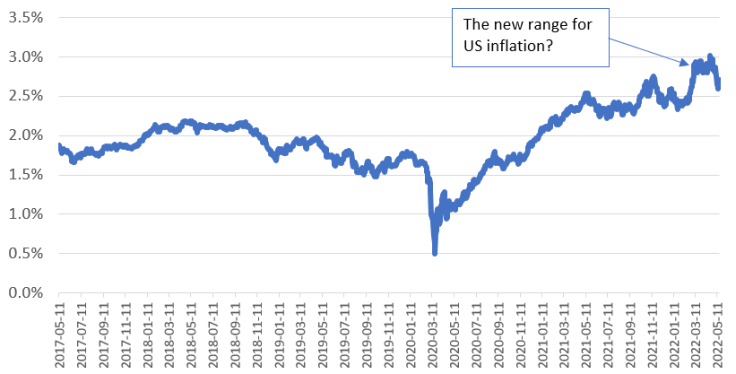

Looking to the future, the market in the US is presently expecting inflation over the next 10 years to be in the 2.5% to 3.0% range. These expectations, which change over time as information becomes available, are calculated by taking the difference in yield between a regular 10-year US Government Bond and a 10-year US Government Inflation Protected Bond.

Expected US Inflation Over the Next 10 Years3

The market is expecting US inflation to moderate from its current rate, for the expectations shown in this chart to come to fruition. However, it does appear that inflation is likely to remain somewhat higher than it was pre-pandemic.

Will There be a Recession?

There is a high likelihood of a recession happening in the next year or two. The high levels of inflation, combined with the ending of government stimulu,s will put a damper on economies around the world. However, different countries will react differently. Canada has an economy with far more exposure to oil, gas, and other resources, which tend to fare well in an inflationary environment. There is a good chance that Canada may fare better through a recession compared to other countries.

The Canadian economy is doing quite well currently, so a recession may cool it off and bring it back to a level that we are used to. For example, unemployment in Canada – currently at 5.3% – is “the lowest rate on record since comparable data became available in 1976,” according to Statistics Canada4.

From an investment perspective, the likelihood of a recession (with some inflation for a while) will change the outlook for different asset classes, as outlined below:

Fixed Income

The first months of 2022 have simply been awful for fixed income. Bonds do not like rising inflation, nor do they like rising interest rates, and both have been present during this time. However, one needs to look forward and, as mentioned above, it does appear that inflation may be peaking and inflation expectations stabilizing. This would be a much better environment for bonds. If a recession does arise, that would be even better for bonds as the existing pressures related to potential inflation and increases in interest rates would ease.

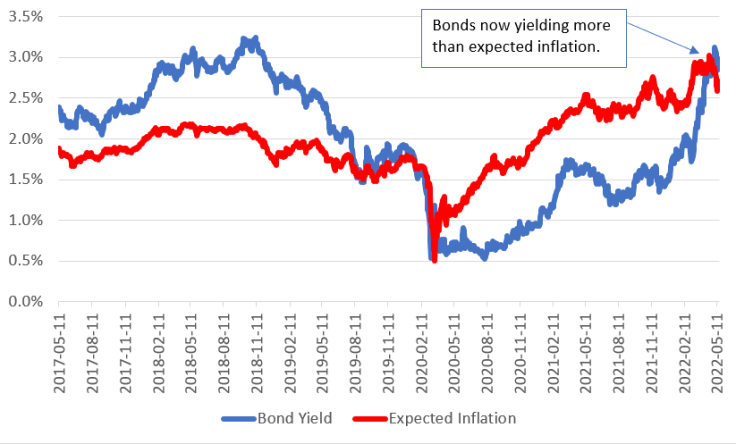

One sign that is pointing to a normalization of the fixed income market is that for the first time since COVID struck, the yield on 10-year US Government Bonds is greater than the expected rate of inflation over the next ten years. That is, bond investors now expect to make money after inflation which should take some of the pressure off further increases in yields.

US 10-Year Bond Yield vs Expected Inflation5

Overall, we expect the outlook for fixed income to be reasonable over the upcoming year, and certainly much better than what has been experienced so far in 2022.

Mortgages

We expect private mortgage investments to continue to perform well in the current environment. Inflation and higher interest rates will have a limited impact on the mortgage portfolio as it has a short-term maturity. This allows the capital to have a quicker turnaround and be lent at a higher rate upon maturity. Additionally, a number of the underlying mortgages are floating rate, which means that each time the Bank of Canada raises interest rates, the rate earned increases.

Should there be a recession, banks would likely tighten their lending standards. If this occurs, more borrowers would be looking for financing from non-traditional lenders. As such, the mortgage lenders we deal with should be able to get better quality borrowers or have the ability to charge higher rates or possibly both. A good thing for our mortgage investments!

Publicly traded mortgage investments are looking to be another bright spot. Throughout last year to earlier in 2022, we had shifted away from publicly traded mortgages as their prices increased and yields decreased. The recent troubles in the stock markets have added to the headwinds these investments face, with the price being pushed down on a few. As the price goes down, the yield goes up, which makes them attractive and as such, we will be monitoring price movements for attractive entry points. This trading strategy for publicly traded mortgage investments has added considerable value over the years.

Real Estate

Real estate has obviously been a great asset class to have been invested in over the last number of years, and we expect it to continue to produce good returns, but at a lower rate. The current economic situation provides some headwinds for real estate but also creates some opportunities:

The Headwinds

- Inflation: Inflation affects real estate by raising the cost of operating existing buildings as well as raising the cost of materials in constructing new buildings. If the rents charged keep up with inflation, then property values should remain stable as higher net operating income is likely offset by rising capitalization rates.

- Higher interest rates: Interest charges on mortgages are usually the largest single cost when owning a property. With interest rates having risen, and perhaps rising further, the cost of borrowing will increase as mortgages are renewed or properties are financed. While this does not directly affect property valuation, it will reduce the cash flow generated which may impact investors.

The Opportunities

- Immigration: On the positive side, 401,000 immigrants came to Canada in 20216 and the Government of Canada is expected to increase immigration levels over the next few years, as outlined below:

Canada’s population is currently about 38.5 million8, so these new immigrants would increase our country’s population by about 3.5%. These people will need to be housed (and work) somewhere, which bodes well for the real estate market in general.

- Price of Real Estate: High real estate costs do not change the demand for real estate. Rather, it simply shifts the demand to different types of real estate. People will gravitate towards the type of real estate they can afford, which may be towards renting or simply buying a smaller property, such as a condo or townhouse. Overall, we expect that the real estate sectors in which we primarily invest (multi-family apartments, for-sale condo/townhouses) to fare well in this environment, as that is likely where new immigrants and new home buyers will gravitate. The headwinds noted above will have the effect of lowering potential returns, but we expect the real estate we target to perform solidly.

Stocks

The decline in some stock markets this year has garnered much media attention. However, most significant declines have occurred in tech-oriented companies that were lauded only a year ago as having substantial growth potential over the long term. Unfortunately, interest rates have risen, there is still a war in Ukraine, and the economic outlook has dimmed. This new reality has changed the growth prospects for these tech-oriented companies, with their prices being knocked down substantially this year.

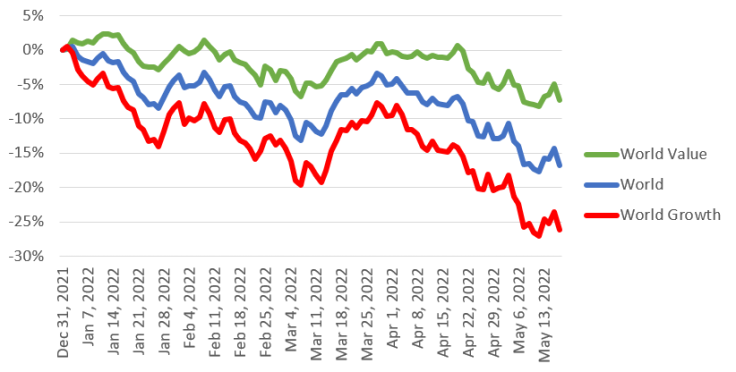

The chart below shows how the MSCI World Index, representing the developed world, has performed so far in 2022, along with the growth and value sides of this index. The MSCI World Growth Index is comprised of those companies that exhibit higher Price/Earnings ratios, lower dividend payouts, etc. That is, mostly the expensive, tech-oriented companies mentioned above. The MSCI World Value Index is the opposite side of the market – those that have higher dividends and lower Price/Earnings ratios – that are much cheaper to buy. As can be seen in the chart, the expensive growth stocks have performed dismally, whereas the cheaper value stocks, while still down, have fared much better:

MSCI World Indices by Style (US$)9

Thankfully, Alitis has avoided much of this pain as we have focused on those cheaper, value stocks rather than on the expensive, growth stocks. The valuation of these growth companies has not made much sense for some time, so our strategy has been to be heavily biased towards the value side of the market, to invest in private equity in order to avoid market fluctuations, and to utilize some hedged strategies to mitigate market volatility.

As for the future, it is likely that the current challenging stock market environment will continue for some time. At Alitis, we will follow our strategy of focusing on value, private equity, and hedged investments while trying to avoid those stocks that could be under further downward pressure as expected economic conditions get priced into the market.

Summary

Inflation has created significant changes in our economic environment due to the necessary policies undertaken during the pandemic. These changes have spilled into the investment world in the form of higher interest rates, likely tighter margins, and lower growth rates in the future. An economic recession may also be in the cards.

It is in times like these when diversification matters most, and at Alitis, our use of different asset types – real estate, mortgage, private debt, private equity, hedging strategies, etc. – has enabled our clients’ portfolios to perform relatively well so far in 2022. The performance of the Alitis Income & Growth Pool compared to other balanced funds provides a testament to the value of our investment philosophy. The economic outlook is not as rosy as it was a year ago, but Alitis’ diversified approach should help investors win in the long term by minimizing substantial losses in the short term.

Disclaimers and Disclosures

- Fund categories included are Canadian Fixed Income Balanced, Canadian Neutral Balanced, Canadian Equity Balanced, Global Fixed Income Balanced, Global Neutral Balanced, Global Equity Balanced, and Tactical Balanced. Funds include different classes of the same fund according to data from Fundata Canada (https://www.fundata.com/)

- US inflation from Federal Reserve Economic Data (https://fred.stlouisfed.org/series/CPIAUCSL), Canadian inflation from Statistics Canada (https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=1810000401)

- US expected 10-year inflation from Federal Reserve Economic Data (https://fred.stlouisfed.org/series/T10YIE)

- Labour Force Survey from Statistics Canada (https://www150.statcan.gc.ca/n1/daily-quotidien/220408/dq220408a-eng.htm)

- US 10-Year Government Bond rates from Federal Reserve Economic Data (https://fred.stlouisfed.org/series/DGS10)

- 2021 Immigration to Canada from news release from Immigration, Refugees and Citizenship Canada (https://www.canada.ca/en/immigration-refugees-citizenship/news/2021/12/canada-welcomes-the-most-immigrants-in-a-single-year-in-its-history.html)

- Immigration targets from Immigration Levels Plan from Immigration, Refugees and Citizenship Canada (https://www.canada.ca/en/immigration-refugees-citizenship/news/notices/supplementary-immigration-levels-2022-2024.html)

- Population estimate from Statistics Canada (https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=1710000901)

- Growth & Value indices from MSCI (https://www.msci.com/documents/10199/178e6643-6ae6-47b9-82be-e1fc565ededb)