From Fear to Financial Success: Overcoming Myopic Loss Aversion

Investing can be a challenging task, as it involves understanding and navigating the nuances of financial markets and managing and mitigating the inherent risks. One human bias that adds to the challenge, and can often affect how investors’ make decisions, is myopic loss aversion.1,2 Myopic loss aversion refers to the tendency of individuals to prioritize short-term gains or losses over long-term objectives.

“The investor’s chief problem and even his worst enemy is likely to be himself.” – Benjamin Graham

We will explore this concept and its impact on investment decisions. We will also highlight how Alitis’ portfolio management team, and our investment pools are positioned to overcome this bias for long-term investment success.

Understanding Myopic Loss Aversion

Myopic loss aversion comes from the fear of immediate losses, which can cause investors to forget the bigger picture and can push them towards making irrational decisions. Investors often exhibit a stronger emotional response to losses than to equivalent gains, leading to a skewed risk perception. As a result, they may opt for safer, low-yielding investments to avoid short-term losses, even if it means sacrificing potential long-term gains.

This bias can prevent investors from enjoying the benefits of compound growth and maximizing returns. By focusing too narrowly on short-term fluctuations, investors may miss profitable opportunities and fail to achieve their long-term financial goals.

An investor who fell victim to this bias and missed the best 10 days of investing over a 15yr period would have reduced their return by 5.5% annually.

$10,000 invested in the S&P 500 (Dec 31, 2007 – Dec 31, 2022)3

Overcoming Myopic Loss Aversion

Today’s environment of instant gratification, the 24-hour news cycle and social media make it harder than ever for us to keep our behavioural tendencies in check. At Alitis, we coach clients to stay focused on the plan and their longer-term wealth goals. We mitigate the impact of myopic loss aversion with a balanced investment approach. Here are some specific strategies that Alitis and successful investors use:

- Set Clear Long-Term Goals: Define specific and realistic long-term financial goals to create a framework for decision-making. Establishing clear objectives helps shift the focus from short-term fluctuations to the broader picture, enabling investors to make more rational choices. The portfolio managers at Alitis update and review your investment policy statement (IPS) at least annually and it is this document that helps you keep you longer term goals on track.

- Diversify Your Portfolio: Diversification is a powerful risk management tool. Spreading investments across different asset classes, such as stocks, bonds, and real estate, can reduce the impact of short-term market volatility. A diversified portfolio allows investors to capture growth opportunities while mitigating losses in specific investments. One of Alitis’ biggest differentiators is the diversification that we include in our pools. Not only do we include asset classes like stocks, bonds, and real estate, but we also include private debt, private equity, and mortgages. We believe adding these additional asset classes will further reduce volatility and potential losses.

- Adopt a Long-Term Perspective: When you look at returns, focus on the 3, 5- and 10-year numbers and embrace a patient and long-term mindset when investing. Recognize that markets go through cycles and that short-term volatility is a normal part of the investment journey. By maintaining a focus on the long-term, investors can ride out market fluctuations and benefit from compounding returns.

Equity Performance in the Long Run4

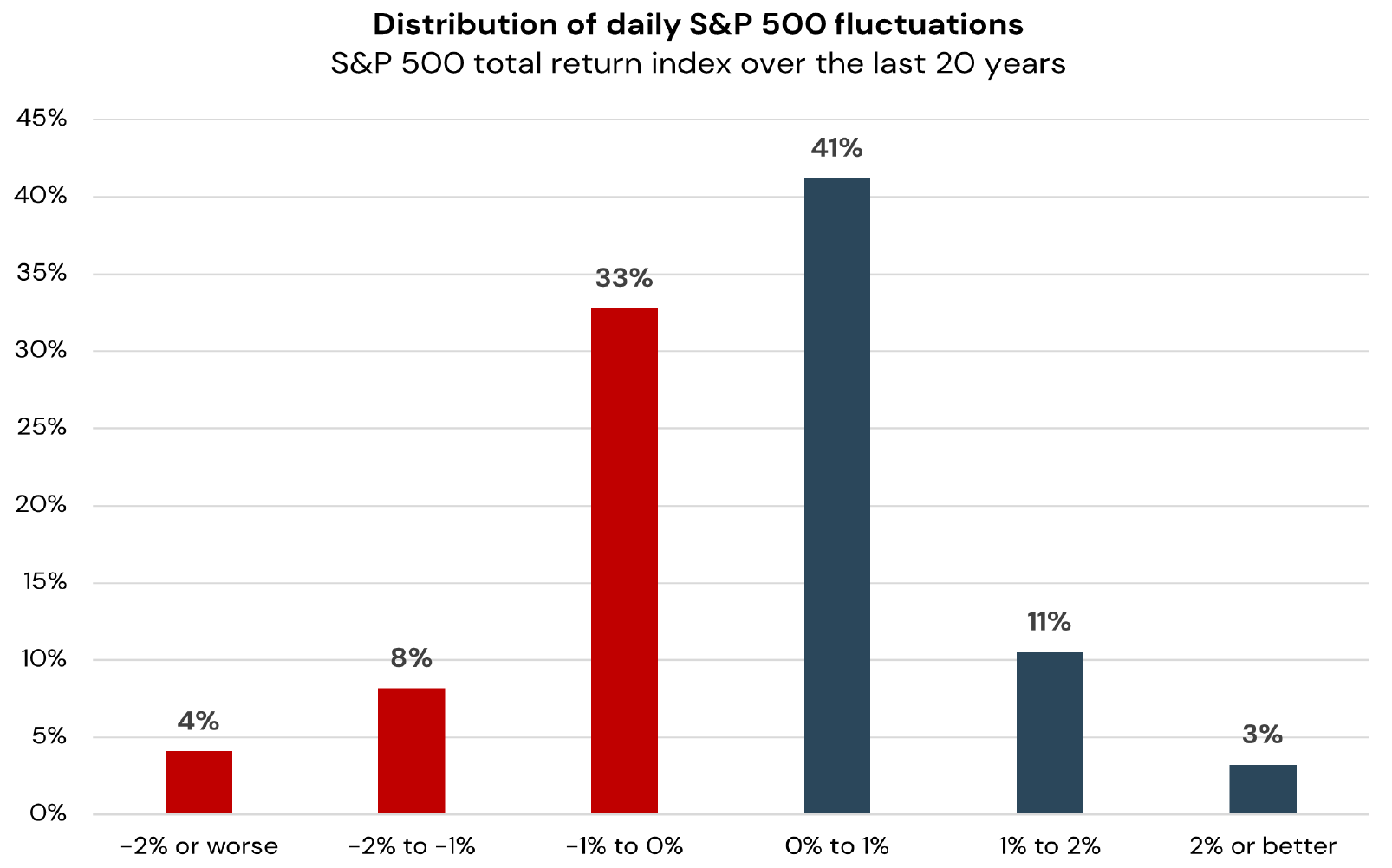

Market fluctuations are normal. Market indexes see gains and losses every day. The accumulation of 0% and 1% days explain much of the positive S&P 500 annualized total return over the last 20 years.

- Regularly Review and Rebalance: Periodically review your portfolio’s performance and make necessary adjustments. Rebalancing involves selling overperforming assets and reinvesting in underperforming ones to maintain the desired asset allocation. This approach ensures that your portfolio remains aligned with your long-term goals and avoids being overly influenced by short-term market movements. During your account review meetings with your Portfolio Managers, we will review your accounts and your goals at least annually and if required, we will sell the overperforming investment pools and re-invest into the underperforming pools. In addition to this review with you, Alitis’ Investment Committee review the Alitis Pools weekly and rebalance as required.

- Seek Professional Guidance: Consulting with an Alitis Portfolio Manager can provide valuable insights and help investors navigate the complexities of investing. A Portfolio Manager can offer objective guidance, help manage emotions during market downturns, and provide tailored strategies to overcome myopic loss aversion.

Conclusion

Myopic loss aversion is a common psychological bias that can hinder investment success. By understanding this bias and implementing strategies to counteract it, investors can make more informed decisions, withstand short-term market volatility, and achieve long-term financial goals. Remember, successful investing requires discipline, patience, and a focus on the bigger picture. By embracing a long-term perspective and adopting prudent investment practices, investors can overcome myopic loss aversion and position themselves for sustainable financial growth.

Contact Us Today

Schedule a no-obligation, complimentary meeting with a Portfolio Manager today. Find Alitis Investment Counsel in Campbell River at 101-909 Island Highway, in the Comox Valley at 103-695 Aspen Rd., in Victoria at 1480 Fort St., and online at alitis.ca. For more information, call 250-287-4933 or email info@alitis.ca.

Disclaimers and Disclosures

- Thaler, R. H., Tversky, A., Kahneman, D., & Schwartz, A. (1997). The Effect of Myopia and Loss Aversion on Risk Taking: An Experimental Test. The Quarterly Journal of Economics, 112(2), 647–661. http://www.jstor.org/stable/2951249

- Boram Lee, Yulia Veld-Merkoulova, Myopic loss aversion and stock investments: An empirical study of private investors, Journal of Banking & Finance, Volume 70, 2016, Pages 235-246, ISSN 0378-4266, https://doi.org/10.1016/j.jbankfin.2016.04.008.

- Time, not timing, is the best way to capitalize on stock market gains. Putnam Retail Management Putnam Investments | 100 Federal Street | Boston, MA 02110 | putnam.com | 2/23 https://www.putnam.com/literature/pdf/II508-ec7166a52bb89b4621f3d2525199b64b.pdf

- Bloomberg L.P. TSX Total Return Index in USD. 1989/01/03 to 2023/03/31. Bloomberg Terminal, 26 April 2023.