Dividend investing and its role within investment portfolios

This article is the first of a series highlighting Dividend Investing and its role within portfolios. The inspiration for this series is the approaching first anniversary of the newest addition to the Alitis suite of funds: the Alitis Dividend Growth Pool. For more information or if you have follow-up questions from this article, please reach out to your Alitis adviser.

As we begin a new year, we thought it would be an excellent time to reflect on the highlights of 2021. For all of us at Alitis, the launch of the Alitis Dividend Growth Pool in January 2021 was a huge milestone and something that had been in the works for awhile. The Alitis Dividend Growth Pool is an all-equity portfolio designed for tax- efficiency with a focus on dividend investing.

What is Dividend Investing?

Dividend investing is a type of equity investing that has a focus on dividend-paying stocks. As a subset of other equity strategies, it is still expected to be correlated with the overall stock market and to carry similar risk and return characteristics. That being said, there are important differences between dividend-paying stocks and other stocks.

Total returns from dividend-paying stocks are comprised of two components – dividend income plus price appreciation (or capital gains). Companies that pay dividends tend to have stable cash flows, robust business models, and consistent dividend payout track records. After all, if a company makes a commitment to a dividend policy, investors expect them to stick with it.

For stocks that do not pay dividends, total returns are entirely dependent on price appreciation. These companies are often newer and have less free cash flow generated within their business models. In some cases, the amount of cash flows can be deep in the red for years. This type of investing places more reliance on the prospects of future earnings potential as opposed to current business operations.

More than the dividend yield, the focus of a dividend investor should be in finding businesses that have strong intrinsic value. The value of a business in technical terms is defined as the present value of all future cash flows that the business can generate. The business (or company) can then decide what to use that cash for – paying dividends (think stocks of Canadian banks), reinvesting in that business (for example extending their R&D capabilities or expanding to a new location), acquiring other businesses to add more value through synergies (think mergers & acquisitions), holding the cash (think Apple), paying down their debt or buying back its shares (think Berkshire Hathaway).

Dividends as a Defensive Tool

In today’s low interest rate environment, low-risk investments like GICs and traditional bonds are not yielding enough to keep up with inflation. Common stocks generally provide an opportunity for more capital appreciation than fixed income investments but are also subject to greater market fluctuations. Dividends as an income stream give investors reassurance in periods of market volatility.

Dividend investing has been around a long time. There are examples of companies as early as the 1600s paying dividends on shares in companies involved in the spice trade between Europe and Asia.1 More recent research has shown that dividend yields have been strong indicators of earnings growth.2

What the Numbers Say

In wanting to do our own research on the matter, we made a simple case study. We took the global broad market stock index (MSCI World Index USD) and measured it against its equivalent for dividend-paying stocks (MSCI World High Dividend Yield Index USD), with monthly data from September 30th, 2021, going back to June 30th, 1995.3 Here is what we found.

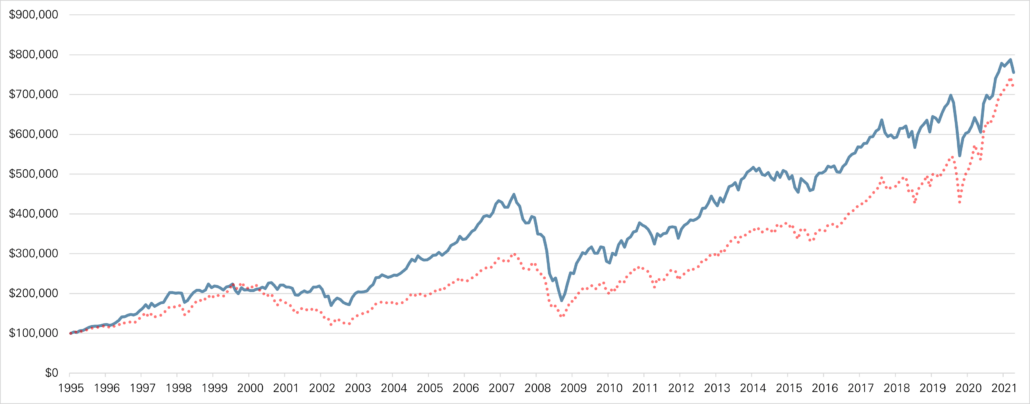

In Chart 1, the dividend-paying stocks (solid line) outperforms the broad stock index (dotted line) over the total timeframe. Dividend-paying stocks would have turned $100,000 USD into $755,548 (an 8.00% annualized return) while the broad stock index would be at $713,140 (a 7.77% annualized return).

Correlation is a measure of how two investments zig and zag together. A correlation of 1 means that the investments zig and zag together while a correlation of -1 indicates that when one zigs, the other zags. The two sets of data stated above are quite highly correlated (0.93, for those keeping score), but there are certainly periods when one or the other outperforms. For example, the dividend-payers outperformed coming out of the 2000 tech bust and had quite the lead until the housing crisis near the end of the decade. For the start of the 2010s, the dividend-payers spent the first half rebuilding their lead, while during the latter half and into the 2020s the broad market index caught up substantial ground.

Chart 1: Growth of $100,000 Dividend-Paying Stocks (solid) vs. Broad Stock Market (dotted)

Data Sources: Bloomberg, Alitis

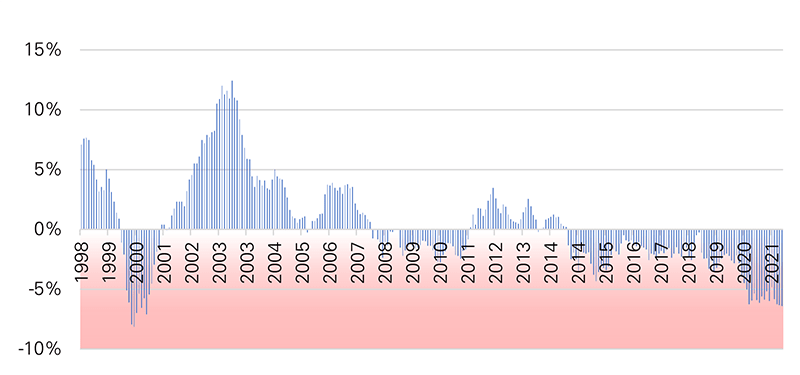

Another way to look at this data is by the 3-year trailing returns. Chart 2 shows the difference of the dividend-paying index and the broad market index over the same period. For example, in 2003 if an investor in the dividend-paying index compared their statements with someone who invested in the broad market, they would have a 3-year annualized return that was over 10% higher. However, if those two investors compared statements as of September 30, 2021, they would find themselves in reversed positions with the broad market investor outperforming on a 3-year basis by about 6% annually.

Chart 2: 3-Year Trailing Return Outperformance for Dividend Index

Data Sources: Bloomberg, Alitis

Based on historical performances, we can see that there are times dividend-paying stocks will generate higher returns than the broad stock market, and there are times when the reverse is true.

It can also be noted that we are currently at the low end of the dividend-payers relative performance over this period. Historically this level of under-performance is similar to what transpired at the height of the tech boom around 1999-2000. Following that episode, dividend investing experienced relative outperformance for several years.

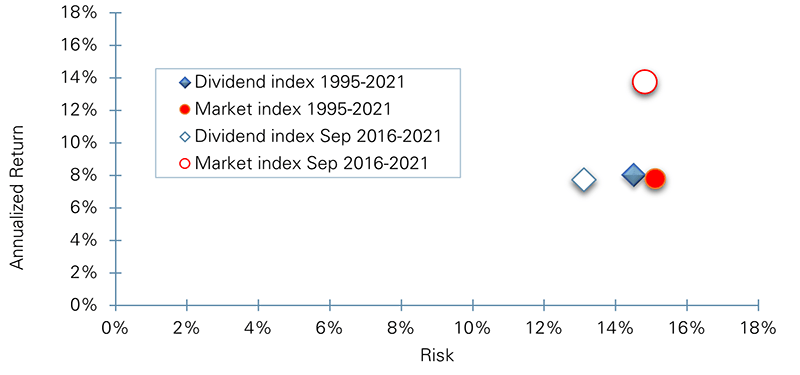

How does the final report card look for dividends versus the broad market? Let’s look at their returns plotted against their risk level (more formally called standard deviation). In Chart 3 we have plotted the values since inception as solid markers, while the outlined markers represent the values over the five years ending September 30th, 2021. In general, items to the top-left of the chart are preferred, while items to the bottom-right have higher risk and lower returns.

Chart 3: Risk-Return

Data Sources: Bloomberg, Alitis

This supports the same story seen above. Dividend investing and stock market investing are both “higher risk, higher return” investment strategies. Dividend investing since inception has achieved roughly the same annualized return with a slightly lower risk level. However, over the most recent five-year period (Oct 2016- Sep 2021), the broad market has had a burst of higher returns, while the dividend-payers have still achieved solid returns with a lower standard deviation.

Summary

In this piece, we have covered a lot of information. We looked at the basic arguments behind dividend investing and we dove deep into the statistics to find whether the arguments hold true. We found that investing in dividend stocks provides a lower risk yet robust performance versus the broad stock market index. We noted that in the last five years, dividend-paying stocks have had positive performance, but the broader stock market has taken off higher in relative terms.

In part 2 of this series, we shift our focus from historical returns to the future. Given extremes in interest rates, equity prices and other variables, we will develop our case for why we expect dividend investing to outperform based on our outlook.

Thank you for reading and we hope you enjoy the upcoming articles of this series.

Apurva Parashar, MBA, CAIA, CIM ®

Associate Portfolio Manager

Alitis Investment Counsel Inc.

Thomas Nowak, CFA

Portfolio Manager

Alitis Investment Counsel Inc.

Disclaimers and Disclosures

- Beattie, A. (2021, May 19). What was the first company to issue stock? Investopedia. Retrieved October 17, 2021, from https://www.investopedia.com /ask/answers/08/first-company-issue-stock-dutch-east-india.asp.

- Arnott, R.D and C.S. Asness. (2003). “Surprise! Higher Dividends = Higher Earnings Growth.” Financial Analysts Journal, Vol.59, No.1, pp. 70-87 https://www.researchaffiliates.com/documents/FAJ_Jan_Feb_2003_Surprise_Higher_ Dividends_Higher_Earnings_Growth.pdf

- MSCI World High Dividend Yield Index (USD) Fund Fact as of September 30, 2021. Retrieved October 30, 2021, from https://www.msci.com/documents/ 10199/74fe7e16-759e-405c-96aa-8350623fae65