Changing Tides and Markets

Tides are fascinating, a captivating force of nature that shapes the coast with power and rhythm. This predictable dance of the moon, sun, and Earth occurs around us every day, uninterrupted.

Uninterrupted, of course, except for the bold moves of human civilization and machinery. Dredging, land reclamation, and changes in the structures or ecology along coastlines have long been in the playbook of humanity. Historical records show that in London, the tidal range (difference between high tide and low tide) quadrupled between the time of the Romans to the Victorian age due to the activity along the River Thames.¹

Financial markets follow their own patterns, with a natural ebb and flow over time. While the celestial bodies in the financial world (inflation, interest rates, economic growth, and market sentiment) may seem predictable at times, we enter the last quarter of 2024 well aware that bold moves of human civilization play a part in the outcomes that will be.

Interest rates are prominent in the news these days. They play a key part in the financial world, as we experience them both as borrowers (mortgage rates) and as savers (interest rates on savings). Mortgages or savings rates do not move in lockstep with the Bank of Canada’s policy rate, but they are certainly correlated. As investors, lower interest rates typically lead to higher prices, while higher interest rates put downward pressure on prices, all else equal.

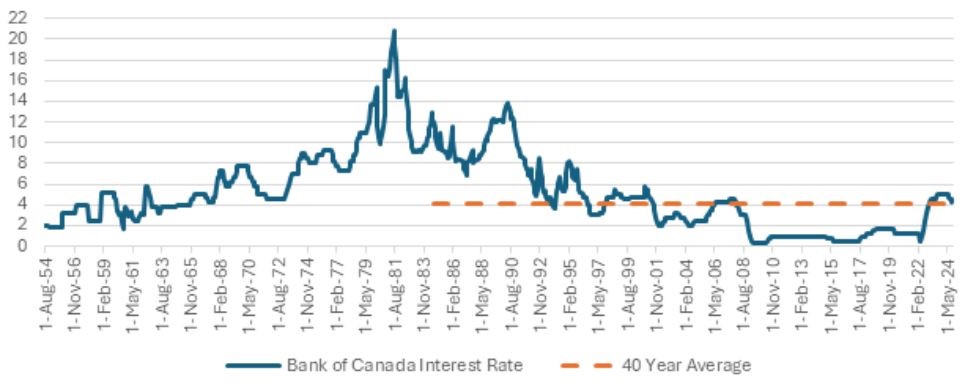

The Bank of Canada started cutting interest rates in June 2024. By September 2024, rates had returned to the same level as in December 2022. While still high compared to recent memory, they are around the average when looking at the past 40 years (since 1984) and below average if you consider the rates from the 1980s.² According to the Bank of Canada, the near-term outlook for interest rates remains downward³, which is supportive of financial assets, all else equal.

Bank of Canada Interest Rate 1935-2024⁴

As you may have guessed, all else is not equal. All else is rarely equal in the financial world, the rest of the puzzle pieces do not wait patiently when one is moved, although it is often helpful to look at past periods as analogs to today.

There are a few examples in the last forty years of markets going through periods where the interest rate is being lowered, often called a “rate cutting cycle”. More often than not, the reason interest rates are being lowered is to try to make a bad situation better by stimulating growth and employment.

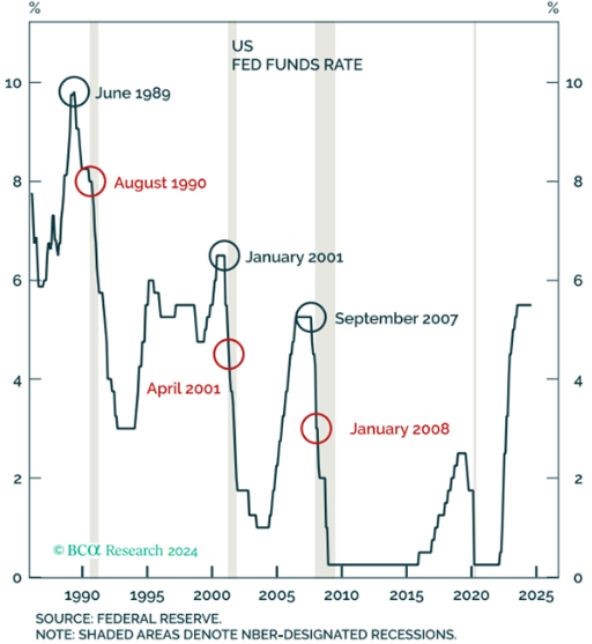

In the USA, here are three examples where the tide could not be completely turned from a recession through interest rate cuts⁵:

- In June 1989, the key interest rate was lowered by almost 2% over the next year, but it did not avert a recession starting in the second half of 1990.

- Between January and March 2001, the key interest rate was lowered by 1% and the recession started one month later.

- Similarly, between September and December 2007, the key interest rate was cut by 1% only for the recession to begin January 2008.

However, there is another example from this period worth mentioning:

- Starting in mid-1995, the key interest rate was lowered by about 0.75% over the next year and there was an economic boom that followed. This also was a time of increased productivity due to several factors including lower oil prices and the internet gaining adoption.

Will the next few months of expected interest rate cuts lend themselves to a scenario more like 1995, or the other time periods? While it is important to consider both possibilities and impossible to predict the future, there are important takeaways that Alitis applies to managing portfolios:

- Knowing your goals, risk profile, and time horizon are essential to making the best investment portfolio for you. No two clients are the same.

- Diversifying is key to achieving strong risk-adjusted returns, as different asset classes will perform well at different times.

- Keeping in mind that investments do involve risk and there will be bumps along the way. While we structure portfolios to reduce the amount of volatility, fluctuations are a natural and normal part of investing.

- Executing your portfolio in the best way possible. Returns from cash investments like GICs (Guaranteed Investment Certificates) are coming down as interest rates move lower. If your investments are meant to be long-term and it fits your plans, consider talking to your Portfolio Manager about how to best meet your needs and objectives in the years ahead.

The tide of interest rates has begun to turn, and just like the changing tides of the sea, this shift brings both opportunities and challenges. While history provides us with valuable lessons, no two periods are identical. At Alitis, our approach remains rooted in thoughtful preparation and careful execution. We are confident that by focusing on your unique goals and maintaining diversified portfolios we can help you weather whatever the financial tides may bring.

Sincerely,

Thomas Nowak, CFA

Co-Chief Investment Officer

Our Team at Alitis

Our dedicated team at Alitis has over 250 years of collective industry experience. But what makes us unique is the high level of integrity that every team member brings to the table.

Along with experience and integrity, each team member at Alitis shares the same commitment to our clients. At the end of the day, we measure our success based on the success of you reaching your financial goals.

If you’re interested in investing with Alitis, let’s have a conversation:

Disclaimers and Disclosures

- Witze, Alexandra. “The Tides They Are A-Changin’ – and It’s Not Just from Climate Change.” Knowable Magazine | Annual Reviews, Knowable Magazine, 22 Apr. 2020, knowablemagazine.org/content/article/physical-world/2020/tides-they-are-changin-and-its-not-just-climate-change.

- “A History of the Key Interest Rate.” Bank of Canada, www.bankofcanada.ca/core-functions/monetary-policy/key-interest-rate/history-key-interest-rate/. Accessed 18 Sept. 2024.

- “Bank of Canada Says It’s Reasonable to Expect More Rate Cuts.” CTVNews, 24 Sept. 2024, www.ctvnews.ca/business/bank-of-canada-says-it-s-reasonable-to-expect-more-rate-cuts-1.7050110.

- “Bank of Canada Interest Rate 1935-2024.” 1935-2024 | WOWA.Ca, wowa.ca/bank-of-canada-interest-rate. Accessed 18 Sept. 2024.

- Berezin, Peter. “Peter Berezin’s Thought of the Day: 25 or 50 – Does It Matter?” BCA Research. Accessed 18 Sept. 2024.