Canadian Housing Market Update

August 2022

Home Price Indices (HPIs) were originally developed for the financial industry to track changes in house prices for the purposes of trading derivatives, which are financial instruments that derive their performance from the performance of an underlying asset, in financial markets. They are now widely used to measure changes in residential house prices over time in a specific geographic market. The MLS® HPI is a more stable price indicator than average prices because it tracks changes in “middle-of-the-range” or “typical” homes and excludes the extreme high-end and low-end properties.1

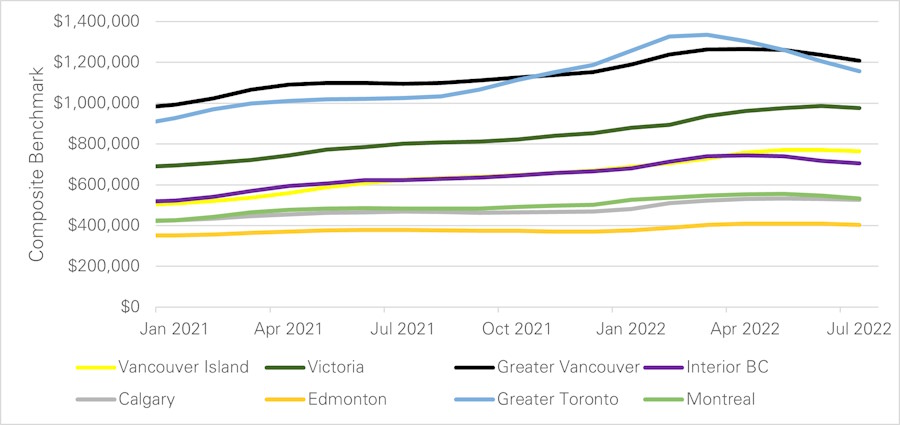

Home prices in areas such as Toronto, Ottawa and to a lesser degree Vancouver, have seen decreases from their record highs at the beginning of 20222. Cities such as Montreal, Calgary and Victoria have continued to see stronger sales with prices remaining near record levels, though not unaffected by the recent housing market downturn. These drops within Canada’s major cities have resulted in the HPI composite average home price in Canada dropping 5% month-over-month and have dropped a total of 10% since the peak of the market in March 2022. Home prices in Canada continue to slip as Canada’s housing market cools off from a red-hot winter.

Though we have seen a 10% decrease in the aggregate composite HPI in Canada, if we dive further into the data, we can note that the aggregate “apartment” price has only seen a 4.6% HPI decrease since its peak in April 2022. Though it is called the “apartment” category, this represents the for-sale condominium market, and not the multi-family apartment asset type. This category is often more stable than the single-family home market as there is a significantly larger demand due to the price point.

When looking closer at specific markets, such as Toronto, though its HPI is down roughly 20% over the past four months, the average home sold price is still up 1% year over year. The HPI Benchmark Price for the Greater Toronto Area (GTA) was $1,157,500 for July 2022, down 4% month-over-month from $1,204,900 in June 2022. This is the fourth month in a row that the GTA’s benchmark home price has decreased month-over-month. Prior to April 2022, the benchmark price had risen for 19 consecutive months, starting from August 2020 until the peak in GTA’s benchmark home price in March 2022.

The benchmark price of homes in Metro Vancouver was $1,207,400 in July 2022, though this was a 2.3% monthly decrease from June 2022. This represents a 10.3% annual increase and 29% increase in the last two years.

The average home sold price in Montreal’s housing market was $576,760, a 6% increase year-over-year, though 5% lower than the record benchmark price in April 2022 of $608,265. Even as home prices in Montreal have decreased slightly, sales in the region continue to slow down, with the number of active listings up 28% year over year. This activity shows the market transitioning away from a seller’s market toward a more balanced market, which has not been seen in the past couple of years.

Chart: Composite Benchmark Breakdown by Region3

Overall, the Canadian housing market is still strong with overpriced homes being adjusted down and buyers having a chance to complete proper due diligence prior to completing a transaction. Exposure times for properties are returning to a sustainable level.

For the remainder of the year and into 2023, we can expect buyers to remain cautious. The continued rise in interest rates makes housing less affordable despite prices coming down. However, we expect buyer confidence to increase once interest rates stabilize. Consensus is that we should see another 0.75% – 1.0% increase in rates4 as inflation remains high, but we could see rates start to decrease by the middle of next year.

Summary

With the increase in interest rates, household purchasing power has decreased and has been redirected away from single family homes and towards the condominium and townhouse markets, which Alitis feels is more accessible and attainable. Canada’s growing population, which is driven by immigration, should help to provide consistent demand for these more affordable properties. The affordable end of the market, whether condos or rental apartments, is where most of Alitis’ real estate exposure is concentrated, so we feel that we are very well positioned within the current economic environment and our investments continue to perform well.

If you’re interested in learning more, let’s start a conversation:

Disclaimers and Disclosures

- Real Estate Board of Greater Vancouver. (n.d.). MLS® Home Price Index explained. MLS® Home Price Index explained. Retrieved August 29, 2022, from https://www.rebgv.org/content/rebgv-org/news-archive/mls-home-price-index-explained.html

- Canadian Housing Market Report Mar. 15th, 2021 | WOWA.ca. (n.d.). Wowa.ca. https://wowa.ca/reports/canada-housing-market

- MLS® HPI Tool – CREA. (n.d.). (Not Seasonally Adjusted) https://www.crea.ca/housing-market-stats/mls-home-price-index/hpi-tool/

- Marte, J., & Saraiva, C. (2022, July 27). FOMC: Fed raises interest rates by 75 basis points to double down on inflation. Bloomberg.com. Retrieved August 29, 2022, from https://www.bloomberg.com/news/articles/2022-07-27/fed-raises-rates-by-75-basis-points-to-double-down-on-inflation