Money Saving Tax Strategies – Follow These Tips to Save Money

These smart financial planning steps can save you bundles of hard-earned income when it comes time submit your taxes.

As we come to the end of another tax season, we’d like to return to some of the basics of financial planning and the value that your Alitis Wealth Management team provides through five strategic planning categories of your tax planning strategy:

- Income Deferral

- Income Splitting

- Income Spreading

- Tax Sheltering

- Tax Credit/Deduction Maximization

The objective of a good tax planning strategy is to structure your affairs legally to minimize the amount of tax you pay. While we would love to spend hours detailing every specific strategy of good tax planning, know that there is a team of professionals who are always looking for opportunities to create efficiencies and savings in your planning and, ultimately, to maximize your wealth.

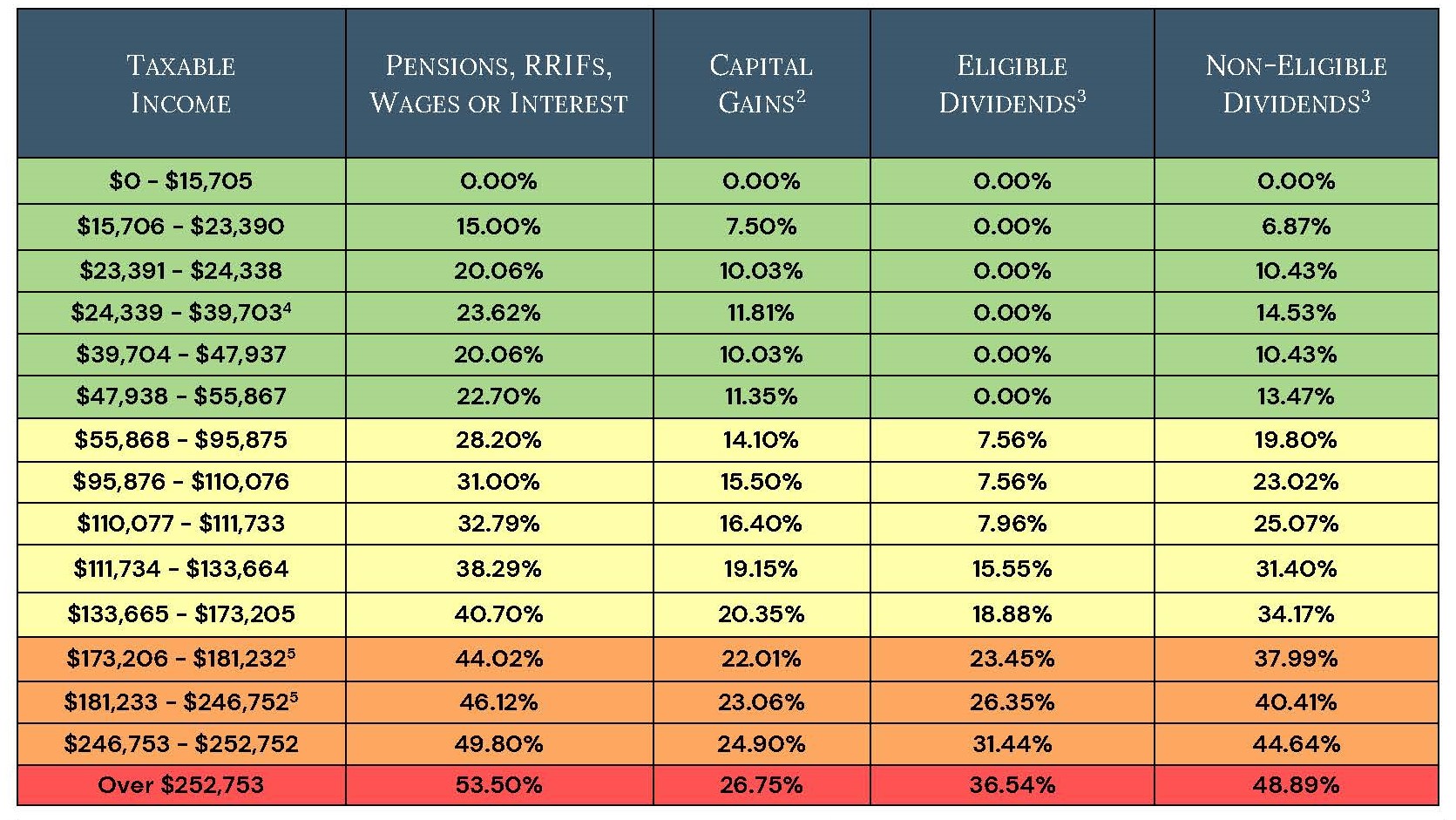

As a review, Canada’s tax system is based on a graduated system, meaning that as your taxable income climbs into the next tax bracket, those dollars will be taxed at progressively higher rates. The following chart illustrates these tax brackets in BC for 2024.

=> Do you need a hand with your income tax strategy? Call Alitis Today.

Combined Federal & Provincial (BC) Personal Taxes – 2024 Tax Year1

What is Income Deferral?

Income deferral is the first tax planning strategy that we consider. Given the choice of paying a tax bill today or paying it in the future when you may be in a lower tax bracket, which would you choose? Unsurprisingly, most of us would defer the tax bill for as long as possible to take advantage of being in a lower tax bracket. Programs like Registered Retirement Savings Plans (RRSPs) fit into this category. In some cases, it may be best to defer converting your RRSPs over to a Registered Retirement Income Fund (RRIF) until it is mandatory, which is December 31st of the year you turn 71. There are situations when earlier, gradual withdrawals will lead to a lower overall tax cost. This is a calculation we factor in when completing our Retirement Income Projections and finding the optimal balance between paying taxes today and throughout your retirement.

What is Income Splitting?

Income splitting is when we look for opportunities to ensure that each dollar earned within a household is taxed at the lowest marginal rate. Because of our graduated tax system, it is more beneficial for two people to have incomes of $50,000 each than to have one spouse at $70,000 and the other at $30,000. For retired couples, income from sources such as CPP, pension income, RRIF, LIF, annuities, and joint investment accounts can be shared to ensure that, as a household, you are paying the least amount of tax possible. For couples in their accumulation years, strategies such as TFSAs, spousal RRSPs, or having the spouse with the higher income cover household expenses and the spouse with the lower income invest are useful tactics for this life phase. Income deferrals are an excellent addition to a smart tax strategy.

What is Income Spreading?

Investments produce one of three types of income: interest, dividends, or capital gains. The objective of our team is to place your investments in the proper investment vehicles for the greatest tax efficiency through income spreading. The most highly taxed form of investment income in taxable accounts is interest, as all of it is taxed at one’s top marginal rate. Eligible dividend income from Canadian corporations receives favourable tax credits and is often taxed at the lowest rate, and can result in a negative tax rate by shifting the dividend tax credit to offset other income at the lower income brackets. And finally, capital gains are taxed at 50% of your gain when the gain is realized. For example, generally, you’d place your interest-generating investments in a registered account such as an RRSP and your dividend-producing and capital gains-generating financial investments in your non-registered, taxable, personal, or corporate account. Two levels of tax savings occur with this planning:

- Immediate annual tax savings on the taxable (Cash) account because you’ve now allocated 100% of the eligible dividend income and capital gains in the Cash account.

- Lower tax on withdrawals and terminal taxes (when you pass) in the RRSP/RIF/LIF account.

What is Tax Sheltering?

The fourth tactic of good tax planning is to take advantage of all available tax shelters to eliminate the effect of income on investments. In 2009, the federal government introduced Tax-Free Savings Accounts (TFSAs), since that time we have used these accounts as an effective tool to shelter all the gains from tax and to shift the least efficient/high income (income spreading) producing investments to these accounts.

Assuming you were 18 in 2009, your total TFSA contribution room in 2024 would be $95,000. If your TFSA is fully funded and you’re looking for another tax shelter where investment earnings might grow tax-free, a lesser-known strategy that is often overlooked is permanent life insurance.

Participating Whole Life and Universal Life Insurance are viable products that can be used to complement other types of accounts. Life insurance can be a highly effective vehicle to deposit savings that can compound tax-exempt income and build a considerable capital value that can be gifted to another family member or charity without any tax payable by the beneficiary.

Families with surplus cash flow or investment accounts can reallocate some of these taxable investments to a tax-free permanent insurance strategy that will still earn a competitive return on par with a taxable, balanced portfolio. Permanent life insurance has some similar features to a TFSA, and without any annual limits; this is using life insurance as a pure investment strategy and not for family protection.

The earlier you start a plan, the lower the internal cost of insurance, making the plan compound even more effectively.

What is Tax Credit and Deduction Maximization?

Finally, we look to help you maximize available tax deductions and credits and understand the difference between these. A tax credit reduces the amount of tax owing, and a tax deduction reduces the amount of your gross income that is subject to income tax. For those still immersed in their working years, maximizing your RRSPs provides a deduction that will save you money on your income tax by deferring tax at your top marginal tax rate.

Refundable tax credits are paid to anyone who qualifies for them, whether they have income or not, with the most well-known being the GST/HST payment.

Additionally, there are non-refundable tax credits such as Age, Pension Income, Disability Amount, Medical Expenses, Charitable Contributions, etc., that are available depending upon the phase of life you are presently in and your personal circumstances. For individuals seeking the tax and social benefits of donating to charities, it is advisable to check CRA’s website to ensure that the charity of choice is a “qualified donee” before making that gift and talk to your Portfolio Manager, Certified Financial Planner, and accountant to ensure that the gift is structured in the most efficient and meaningful way.

All the above-illustrated examples showcase the various possibilities that an individual or a household can undertake to pay less tax. These legal tax strategies offer ways to increase after-tax returns simply by paying less tax. As your Alitis Wealth Management Team, we invite you to be curious at your next review and ask us if you are taking full advantage of the many strategies that exist for you to reduce your taxes now and in the future. And, rest assured that as students of our industry, we continue to seek out ways to enrich your planning.

Sincerely,

Emily Hoffman, CIM®, CFP® Portfolio Manager

Associate Portfolio Manager

Alitis Investment Counsel

Certified Financial Planner

Insurance Advisor

Alitis Wealth Planning

Disclaimers and Disclosures

- Combined Federal & Provincial (BC) Personal Taxes; https://www.taxtips.ca/taxrates/bc.htm

- Marginal tax rate for capital gains is a % of total capital gains (not taxable capital gains)

- The rates apply to the actual amount of taxable dividends received from taxable Canadian corporations. Eligible dividends are those paid by public corporations and private companies out of earnings that have been taxed at the general corporate tax rate (the dividend must be designated by the payor corporation as an eligible dividend). Where the dividend tax credit exceeds the federal and provincial tax otherwise payable on the dividends, the rates do not reflect the value of the excess credit that may be used to offset taxes payable from other sources of income.

- Individuals resident in British Columbia on December 31, 2024 with taxable income up to $23,390 generally pay no provincial income tax as a result of a low-income tax reduction. The low-income tax reduction is clawed back on income in excess of $24,338 until the reduction is eliminated, resulting in an additional 3.56% of provincial tax on income between $24,339 and $39,703.

- For 2024: from $14,156 to $15,705 for taxpayers with net income of $173,205 or less. For incomes above this threshold, the additional amount of $1,549 is reduced until it becomes zero at net income of $246,752. The marginal rate for $173,205 to $246,752 is 29.32% because of the personal amount reduction through this tax bracket. The additional 0.32% is calculated as 15% x ($15,705 – $14,156) / ($246,752 – $173,205).