Alitis Asset Management

Alitis Asset Management is a division of Alitis Investment Counsel Inc.

Overview

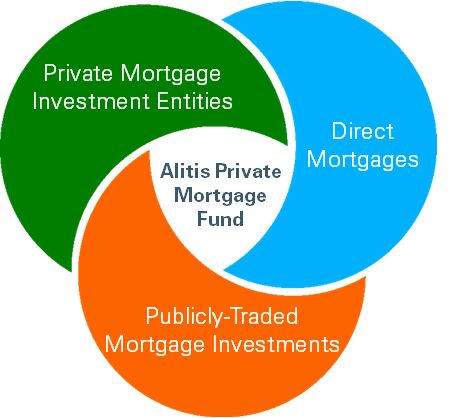

The Alitis Private Mortgage Fund is designed and managed differently from other mortgage investments in Canada. Our fundamental premise is that there are plenty of good mortgage investments available, but they are not packaged in a manner that is truly beneficial or easily accessible to investors. We solve these issues by combining the three different approaches to mortgage investing into one package:

- Private Mortgage Investment Entities

- We start with a core of institutional and best-in-class private mortgage offerings to create a diversified foundation to mitigate risks.

- Publicly-Traded Mortgage Investments

- We strive to enhance returns by trading in public mortgage securities when their valuation is favourable compared to private mortgages. Public securities also provide further liquidity for the fund.

- Direct

Mortgages - We invest directly into specific mortgages to customize exposure, manage risk and enhance returns.

A Core of Private Mortgage Funds

Externally-managed private mortgage investments form the core of the Alitis Private Mortgage Fund. Our view is that since mortgage lending requires a good deal of local/specialized knowledge, it simply makes sense to use firms who know their local markets or specializations well. To do this, we have interviewed many firms offering private mortgage opportunities and have selected those which have demonstrated their abilities and look for those investments which add to our desire for diversification across different perspectives, such as:

- By Region – We start by finding mortgage allocations that diversify across multiple locations so that economic issues in one area can hopefully be offset by those areas where there are no issues.

- By Type of Borrowers – We have exposure to both single-family residential borrowers (detached, townhome, condo) and large corporate borrows for commercial properties and developments.

- By Lending Approach – Most lenders find a niche where they can excel, so we look for those firms which have different, yet complementary, lending approaches to further enhance diversification. For example, within the residential market, we work with firms which do traditional lending to owner-occupied homes, firms which do consumer lending backed by real estate, as well as those who provide mortgages for residential construction.

- By Security – In aggregate, the portfolio of private mortgage funds are predominantly first mortgages, however, there are second and third mortgages as well. The risk/reward trade-off of the different levels of security is considered when choosing these investments.

- By Redemption Notice – As the Fund has monthly liquidity, we are cognizant of selecting private mortgage funds so that there is always a reasonable amount of liquidity readily available.

Below are some of the private investment firms in which the Alitis Mortgage Fund has investments. While it is our view that each of these firms is individually good, there is always a chance that one or more of them may have to halt redemptions for some reason. Utilizing a range of private mortgage investments allows us to diversify this risk and provide liquidity that our investors require.

Some of the firms in which we invest include:

Complemented by Publicly-Traded Mortgage Investments

Our publicly-traded mortgage strategy starts by determining the expected return from the private mortgage investments over the upcoming year and using that as the starting point. Ultimately, all the mortgage entities we look at operate in the same space so the expected return from similar investments should be roughly the same over the long term.

Publicly-traded mortgage investments must deal with the vagaries of the public markets so their expected return varies over time. If publicly-traded securities are expected to deliver 35% better returns than private securities over the upcoming year, then we will look to increase the exposure to publicly-traded securities. Conversely, publicly-traded mortgage investments will get trimmed back when they get to their full value as compared to the private investments. Trading in public mortgage investments does add some volatility to the Fund but provides the opportunity to increase returns, as well as creating liquidity since these investments are marginable.

The universe of publicly-traded mortgage investments in Canada is quite small and we only follow the more liquid options. In the United States, mortgage REITs are available but we have never invested in them as they are much more leveraged and volatile than the options available in Canada. Publicly-traded mortgage investments are limited to a maximum of 30% of the portfolio.

And Select Direct Mortgages

Directly investing into specific mortgages is our newest strategy and was first used within the Fund in mid-2021. While we firmly believe that a diversified core of private mortgage entities provides the best foundation for the Fund, we are also aware that the management costs of these investments reduce the return to investors. Directly investing into mortgages allows us to capture more of the return that is available as well as being able to tailor the exposures and risk of the Fund.

We are looking to increase the allocation to direct mortgages in the Fund to the 10-15% range over the next several years.

Let’s Connect!

Chris Kyer, CIM®

Senior Distribution Manager

416.938.4490

ckyer@alitis.ca

Offering Memorandum

Subscription Agreement