2023 Investment Market Review: Inflation & Interest Rates Set The Tone

2023 has come to a close, and what a year it has been in the investment world. After the very rocky 2022, it was nice to see a return to something more normal, although still with its challenges. So, here is a recap of how Alitis did last year and the major events that impacted the investment returns.

Investment Strategy: Focus on What Could Be Most Controlled

Our strategy at the beginning of 2023 was to focus on those investments over which we had the most control or which we had the greatest conviction. We ranked our four major asset classes in the following order:

- Mortgages: On a risk-return basis, this was our favoured asset class.

- Real Estate: We expected a higher return than mortgages, but the risk level had increased due to rising interest rates.

- Bonds: With inflation appearing to have peaked, there were expectations of interest rates stabilizing or declining, making bonds attractive again.

- Equities: There were still many unknowns in the markets, valuations remained elevated, and interest rates were considerably higher. The performance of stocks was uncertain; they could either thrive or falter. There were expectations that volatility was going to be high, which we view as unfavorable.

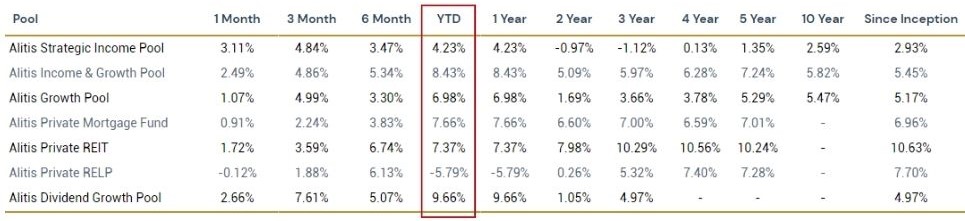

We made our asset allocation decisions based on these broad outlooks and, for the most part, they were good. However, there were some challenges, particularly related to one specific real estate investment. The returns for Class E Units of the Alitis Pools are shown below:

Returns to December 31, 2023

Economic: Inflation Set the Tone

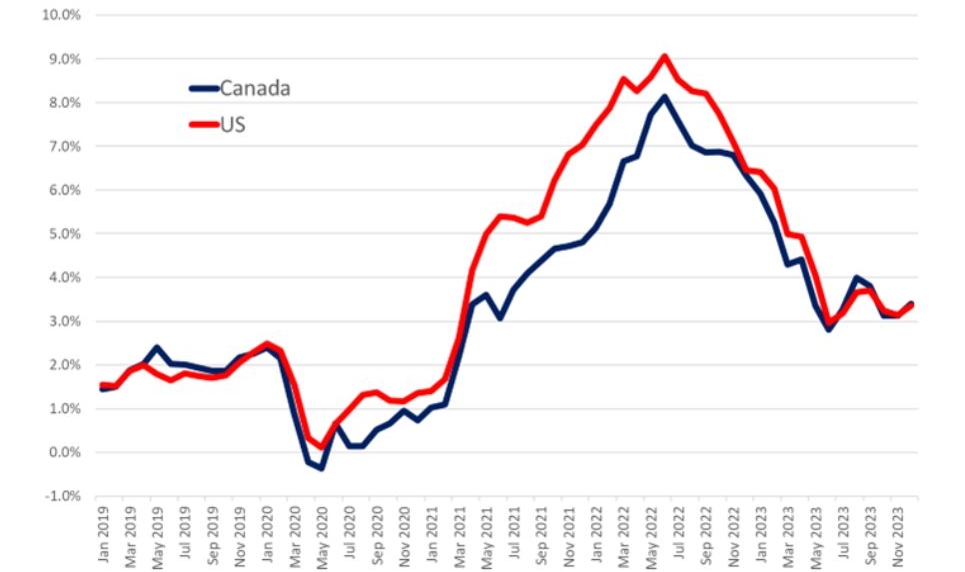

The outlook for inflation was the critical element being looked at in 2023 as inflation truly sets the conditions for the economy, interest rates, and ultimately investments. The inflation rates for Canada and the US are shown below:

Inflation Rates (year-over-year)

The COVID lockdowns that started in 2020 and the responses by governments around the world left quite the hangover – one that is still carrying on. Year-over-year inflation rates were already declining at the beginning of 2023 and this did set the background for many of our assumptions. The big question was how low would inflation go? It was very unlikely that it would go back to where it was before COVID (approximately 2%) and as the year progressed, it appears that the new level of inflation is starting to hover in the 3.0% to 3.5% range. This is not a very high rate, but it is somewhat different than what we had only four years ago and it does change the math which surrounds investment valuations.

Bonds: Interest Rates Stabilized

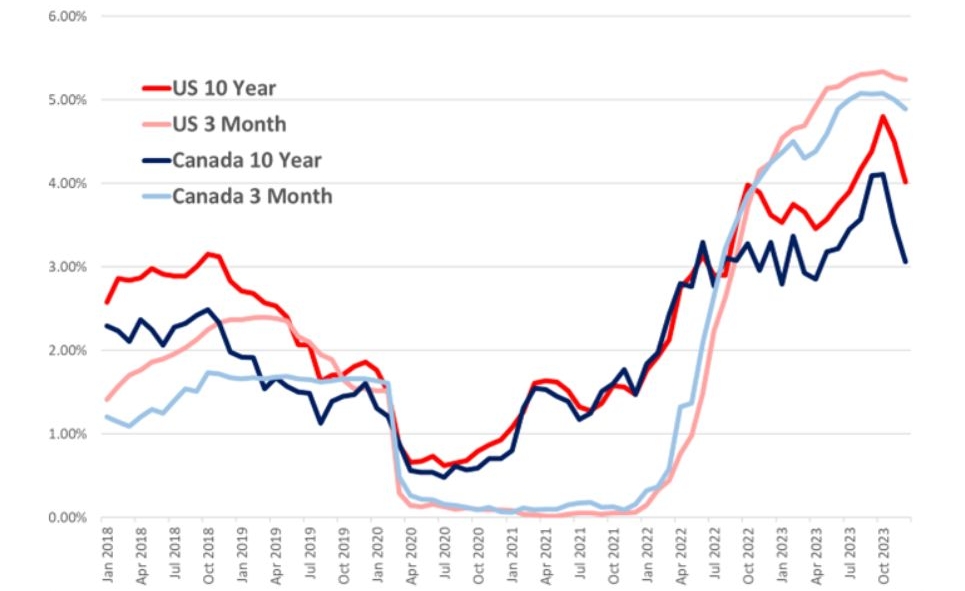

The years 2021 and most of 2022 were marked by the steady climb in interest rates, which has had a significant impact on all parts of the economy. The short and long-term interest rates for Canada and the US are shown below:

Interest Rates

With inflation easing, it was our view that interest rates would stabilize and perhaps even decline a bit as the year progressed. Rates appear to have peaked in October and come off a bit, which helped deliver solid returns for the bond component of the Alitis funds, much as we had expected at the beginning of the year. However, having short term rates being higher than long term rates (known as an inverted yield curve) has often been a reliable indicator of an upcoming recession, which continues to be something we are concerned about.

Mortgages: Good Conditions

The asset class for which we had the most conviction at the beginning of 2023 was mortgages. With rising interest rates in an uncertain economic environment, traditional lenders generally will raise lending standards – but this is great news for the mortgage market in which Alitis invests. The mortgages in the Alitis Pools had an average term to maturity of about one year and more than half were variable-rate mortgages. When all of this is combined, there was a greater demand for non-traditional mortgages which allowed for higher rates to be charged or the quality of the average borrower to be increased. Overall, this asset class had a very good year, as shown by the 1-year return of 7.66% for the Alitis Private Mortgage Fund.

Real Estate: Resilience in the Face of a Challenging Environment

We expected real estate to have a good year, but one that was not without its challenges. Real estate investments generally involve a sizeable amount of debt and rising interest rates make this debt much more costly. Thankfully, a significant portion of the real estate in which we invested had mortgages locked in at fixed rates. While we were not completely immune to the increased debt costs, this helped soften the blow to our real estate investments and their returns. Additionally, our focus on multi-family residential properties is generally considered the least risky component of the real estate market. With the influx of new people coming to Canada, this only added to the downside protection offered by multi– family residential properties. Increased immigration, coupled with continued strong fundamentals (low supply, high demand), and expectations for lower interest rates over the coming years, going forward we anticipate our real estate investments will perform more in line with our long-term return expectations.

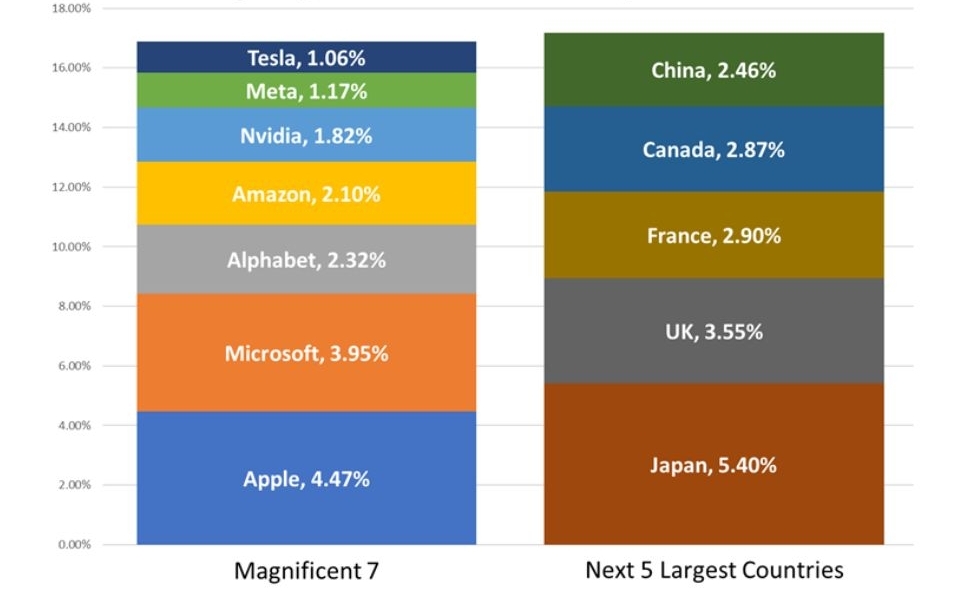

Equities: Magnificent 7 vs Reality

The biggest story of 2023 in the equities space was the rise of the so-called Magnificent 7 stocks – Apple, Microsoft, Alphabet (Google), Amazon, Nvidia, Meta (Facebook), and Tesla. These seven technology and related stocks drove the bulk of the returns achieved in the US stock market last year. There is no arguing that they had a wonderful year! However, one needs to look at reality and assess whether the value attributed to these seven stocks makes sense. According to weighting indicated by Morgan Stanley’s All-Country World Index, these seven companies have grown so large that at the end of 2023 they were valued about the same as the entire stock markets of Japan, the UK, France, Canada, and China combined:

Weightings in the MSCI All-Country World Index¹,²

There is no doubt that the Magnificent 7 are excellent companies. It was our decision in 2023 to minimize exposure to these and other growth-oriented stocks, and that decision did hurt performance last year. However, when the value of these seven companies rivals the value of the entire stock markets of Japan, the UK, France, Canada, and China, one has to consider that something is amiss. Prudence would dictate that there is less risk investing elsewhere as opposed to these seven stocks which make up almost 17% of the global stock market.

Looking Forward To 2024

So, what is our outlook for 2024? For the most part, we anticipate a continuation of the themes we identified in 2023 with some changes to reflect new information.

The Key Drivers: Inflation & Interest Rates

As was the case in 2023, inflation and interest rates will be the most closely watched measures that will dictate much of what will happen. As noted above, inflation appears to have found a new level in the 3.0% to 3.5% range. This is higher than the 2% level to which central bankers wish to return. As such, it is likely that interest rates will stay about where they are now until there is some sign that economies are weakening and inflation is easing. That being said, it is likely that interest rates will ease off as the year progresses.

Economic Growth: Not Great. Recession?

Generally speaking, the economic growth rate for the world is expected to slow in 2024. Canada and the US are not immune and are expected to have real growth rates of 0.8% and 1.5% respectively, according to the Organization for Economic Cooperation and Development (OECD).

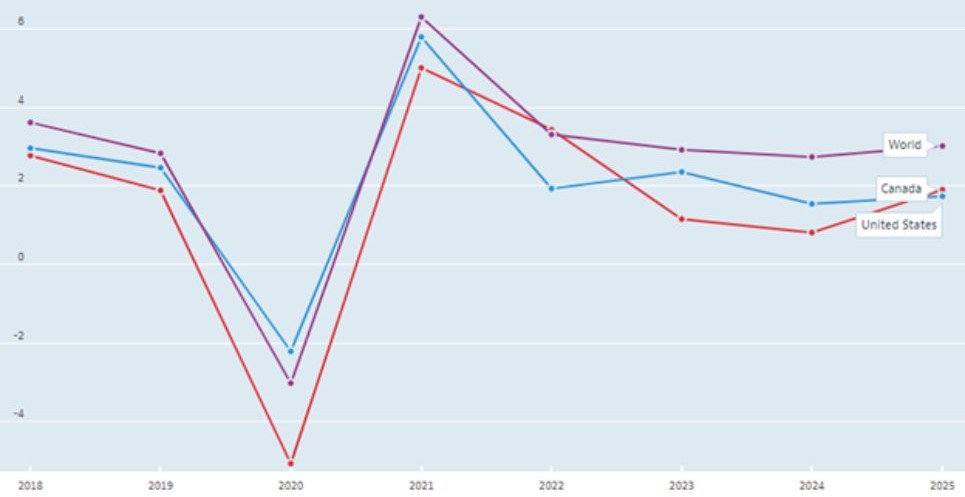

Real GDP Growth Rates³

These growth rates are not great and there is the possibility that Canada and the US could tip into a recession. The inverted yield curve mentioned earlier has been a good predictor of recessions in the past so it would be unwise to ignore this warning sign.

Alitis’ Outlook: Similar to 2023

More asset classes have allowed Alitis to have more investment options during a broader range of economic conditions. Once again, we are of the opinion that our two main alternative asset classes – real estate and mortgages – will provide the best returns in 2024 as shown in our ranking of the four major asset classes:

- Real Estate: We expect the highest returns in this asset class with a little less risk than 2023 as interest rate shocks have generally been absorbed. Our focus on multi-family residential is expected to mitigate risk due to low vacancy rates and a large inflow of people to Canada.

- Mortgages: On a risk-return basis, this should still be a very solid asset class. Interest rates may come down later in the year, so it is anticipated that returns will remain similar to last year.

- Bonds: Declining yields later in the year should enable bonds to put in another decent year by earning their yield plus the potential for some capital gains as bond prices rise. A recession would help bonds out even more.

- Equities: There are still many unknowns in the markets, valuations (particularly with the Magnificent 7) are still stretched, and the possibility of a recession make stocks once again the riskiest of the asset classes.

Alitis Income & Growth Pool: A Reflection of Our Views

Our views on asset classes are expressed most clearly in the asset allocation for our flagship investment, the Alitis Income & Growth Pool where we are shifting to over-weighted in Real Estate and Mortgages, roughly neutral for Fixed Income, and under-weight in Equities:

- Asset

Class - Cash

- Fixed Income

- Mortgages

- Equities

- Real Estate

- Long Term Strategic Asset Allocation

- 0%

- 30%

- 20%

- 30%

- 20%

- Present Tactical Asset Allocation

- -3%

- 29%

- 24%

- 18%

- 32%

- Over/Under

Weighting - -3%

- -1%

- +4%

- -12%

- +12%

Conclusion

Overall, we expect another solid year with Alitis’ much broader range of asset classes again playing a significant role in achieving solid returns with less risk. If you have any concerns or questions, please reach out to your portfolio manager. Have a great 2024!

Kevin Kirkwood, CFA

Chief Investment Officer

Our Team at Alitis

Our dedicated team at Alitis has over 250 years of collective industry experience. But what makes us unique is the high level of integrity that every team member brings to the table.

Along with experience and integrity, each team member at Alitis shares the same commitment to our clients. At the end of the day, we measure our success based on the success of you reaching your financial goals.

If you’re interested in investing with Alitis, let’s have a conversation:

Disclaimers and Disclosures

- “MSCI ACWI Index (USD) Index Factsheet.” MSCI Inc, www.msci.com/documents/10199/8d97d244-4685-4200-a24c-3e2942e3adeb. Accessed 20 Feb. 2024.

- “Ishares MSCI ACWI ETF: Acwi.” BlackRock, www.ishares.com/us/products/239600/ishares-msci-acwi-etf. Accessed 20 Feb. 2024.

- “GDP and Spending – Real GDP Forecast – OECD Data.” Organisation for Economic Co-Operation and Development, data.oecd.org/gdp/real-gdp-forecast.htm. Accessed 20 Feb. 2024.