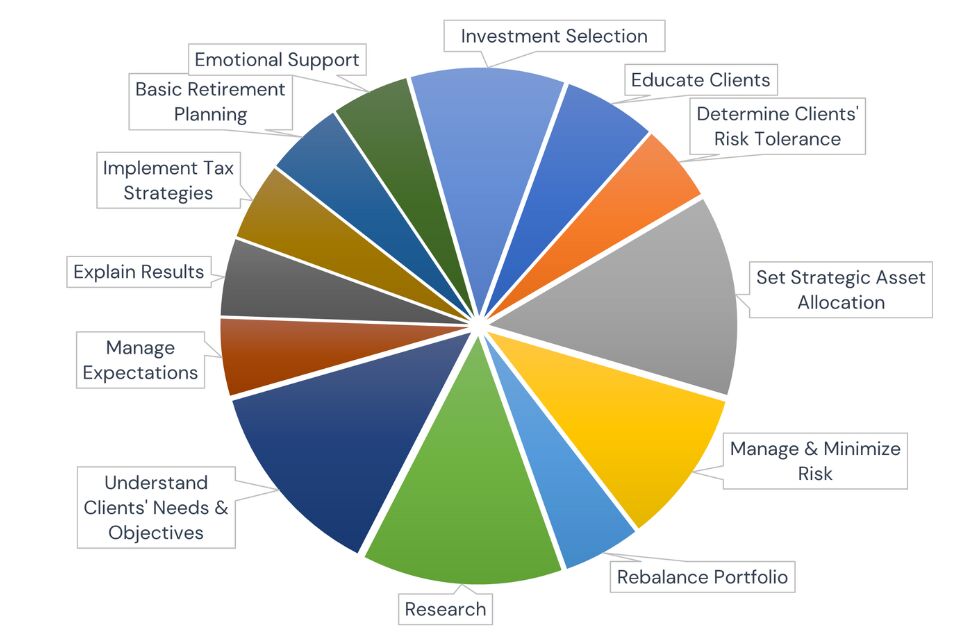

What Does a Portfolio Manager Actually Do?

Part 2 in the series of what people think Portfolio Managers do vs. what they actually do.

In Part II of this series, I’m going to walk you through the process a Portfolio Manager follows to design a portfolio best suited to the needs of their clients. Refer to Part I.

Choosing a financial professional is a big decision. It can be confusing when terms, titles, and designations may be used interchangeably in the wealth management industry. Portfolio managers are different from other financial professionals such as investment advisors, mutual fund dealer representatives, and financial planners because they discretionarily manage clients’ accounts. In other words, we have the authority to make investment decisions on behalf of our clients. Investment decisions therefore must be independent and free of bias.

The Role of a Portfolio Manager

Understand Clients’ Needs & Objectives

Portfolio managers build and manage a collection of investments (a portfolio) designed to suit the needs of their clients. Understanding their objectives and knowing their personal and financial circumstances is essential for us to recommend investments best suited to our clients. Some factors, such as time horizon and liquidity requirements, limit which investments are suitable for a client’s portfolio.

Determine Clients’ Risk Tolerance

Everyone has both an ability and willingness to bear risk and often those factors do not align. Willingness to bear risk could be considered your appetite for risk. Usually, this is driven by the lure of returns and sometimes also the fear of loss, also known as myopic loss aversion. The ability to bear risk is more practical; it requires a portfolio manager to assess the impacts on a client’s finances from adverse investment outcomes. A thorough understanding of our client’s financial situation and needs allows us to determine our clients’ ability to bear risk, and ultimately their overall risk tolerance. This is one of the reasons Know-Your-Client or “KYC” requirements are such a prominent part of securities regulation in Canada.

Set Strategic Asset Allocation

Part of the Alitis Investment Management Process is setting the strategic asset allocation. Asset allocation is a portfolio manager’s main control over risk and potential returns. It is the process of dividing investments in a portfolio among different asset categories – such as stocks, bonds, cash, and alternatives. Asset allocation can explain about 90% of the period-to-period variability of a portfolio’s returns.1

Investment Selection

After the strategic asset allocation is set, the portfolio manager starts selecting investments. Investment selection is a meticulous process that involves identifying and choosing specific securities to include in a portfolio. This selection is based on a comprehensive analysis of various factors, including their client’s financial goals, risk tolerance, time horizon, and market conditions. We leverage our expertise and market insights to make informed decisions about which stocks, bonds, mutual funds, or other assets to buy or sell within the portfolio. We aim to strike a balance between risk and return, diversify holdings across different asset classes, and continually monitor and adjust the portfolio to optimize its performance in line with our client’s objectives. Most of the Alitis Investment Committee consists of team members who hold the Chartered Financial Analyst (“CFA”) designation and who make the individual investment selections within the Alitis portfolios.

Research

There is unlimited news and public information available to any investor. In addition to analyzing individual securities, a portfolio manager typically monitors global economic indicators, market trends, geopolitical impacts, tax, and regulatory changes. Even though we know we can’t predict the future, human nature drives us to try. Forecasting potential future outcomes is a common practice in the finance industry. The Alitis Investment Committee performs the vast majority of our research, allowing client-facing portfolio managers more time to focus on their clients.

Rebalance Portfolio

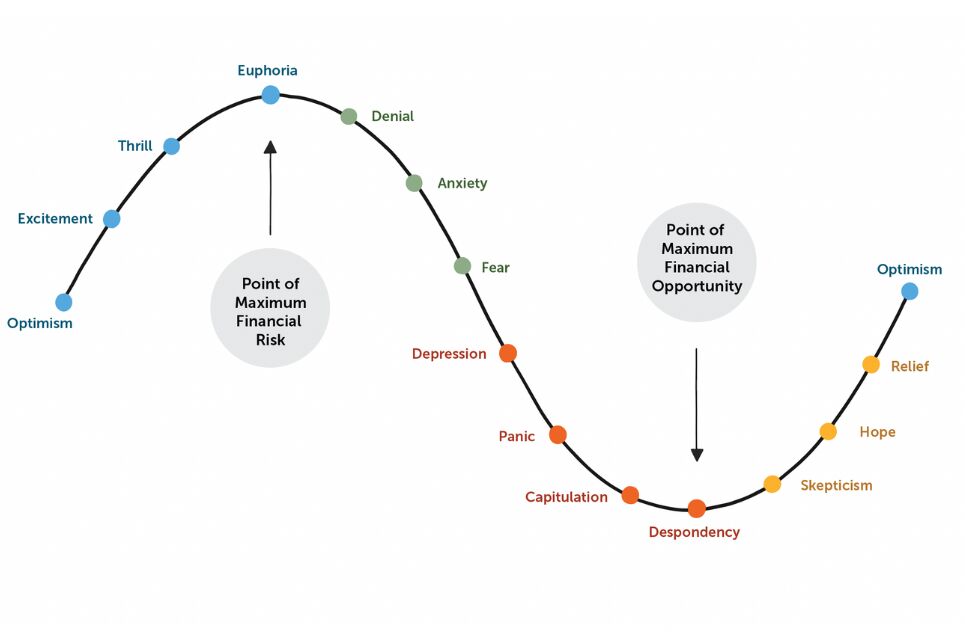

Once the asset allocation is set, it requires ongoing maintenance to ensure the target asset allocation remains in place. This process is known as rebalancing. When applied systematically, without emotional bias, rebalancing reduces investment risk. Rebalancing implements the advice of buy low and sell high. The concept is easy to grasp, but unfortunately, it can be very challenging emotionally to implement. Having a portfolio manager rebalance for you takes the emotion out of the decision and protects you from being lured into selling your losing investments to buy more of your winners which is essentially buying high and selling low.

Manage & Minimize Risk

Portfolio managers are constantly assessing a broad range of risks, such as market risk, currency risk, individual security risk, and more. Diversification is the most effective strategy portfolio managers utilize to reduce risk. By spreading investments across different asset classes (e.g., stocks, bonds, real estate), industries, and geographic regions, the impact of poor performance in any one area is reduced. Colloquially, we all understand the wisdom of “don’t keep all your eggs in one basket.” Managing risk is an Alitis specialty. We go well beyond standard diversification by incorporating alternative asset classes. The Alitis Pools are designed to withstand a wide range of outcomes, most with much lower volatility compared to similar products.

Implement Tax Strategies

A portfolio manager can optimize an investor’s after-tax returns by implementing tax-efficient strategies. Making deliberate choices about when to buy or sell assets can minimize capital gains tax. Considering the tax implications of dividends and interest income can maximize the benefits of tax-advantaged accounts like Tax-Free Saving Accounts (TFSAs), Registered Retirement Savings Plans (RRSPs), and the new First Home Savings Account (FHSA). Being aware of each client’s individual tax situation allows for strategic placement of assets between taxable and tax-advantaged accounts, as well as the strategic draw-down of RRSPs in retirement. The overall goal is to minimize our clients’ overall tax liability during their lifetime to enhance their long-term wealth accumulation while providing a more tailored and holistic investment solution.

Basic Retirement Planning

Portfolio managers work closely with clients to set retirement goals and consider factors such as desired retirement age, income needs, and risk tolerance. Based on these goals, we craft investment strategies that align with our client’s retirement objectives. Additionally, we keep a watchful eye on market conditions, making adjustments as needed to ensure that their retirement plan stays on track. By providing expert guidance and investment management tailored to retirement needs, portfolio managers play a critical role in helping individuals work toward a financially secure and comfortable retirement.

The next several items are related to people, as clients after all are our raison d’être. The entire profession exists to support clients who have accumulated wealth. From a young family saving for their children’s education to a large corporation safeguarding their employees’ pension funds. Having wealth comes with the burden of caretaking it. Portfolio managers step in to relieve their clients of that burden.

Explaining Results and Managing Expectations

A vital part of a portfolio manager’s role is effectively communicating results, both positive and negative, while managing client expectations. Portfolio managers must provide transparent and clear explanations of portfolio performance, both in terms of returns and risks. We help our clients understand how their investments are faring in relation to their financial objectives and the broader market conditions. Importantly, they manage expectations by setting realistic goals, emphasizing that investments can fluctuate and that short-term variations are normal. During periods of market turbulence, we reassure clients, helping them stay committed to their long-term strategies and resist making hasty decisions based on emotional reactions. We are all vulnerable to the cycle of investor emotion (see chart below). By maintaining open, honest, and proactive communication, we as portfolio managers foster trust and confidence, ensuring our clients remain informed, focused on their financial goals, and well-prepared to navigate the inevitable ups and downs of the investment landscape.

The Cycle of Investor Emotion2

Emotional Support

Money is emotional. We all have triggers and hang-ups around it. Even professionals are not immune. Making decisions is hard, especially ones that rely on unknown future outcomes. Emotional biases can have a significant negative impact on investment returns over time. As portfolio managers, we help our clients avoid common biases. We do our best to meet them where they are when it comes to discussing their personal finances. Often as portfolio managers, we hear about our client’s family, health, wealth, dreams, and fears. We see their successes and failures. We know and care about them as people and offering emotional support is one small way, we can make a difficult and sometimes intimidating process easier.

Educate Clients

Many clients appreciate education from their portfolio managers, the opportunity to better understand what’s going on with their investments and how the financial system works. Finance is an industry that offers a lifetime of learning opportunities. We cover investments, markets, economies, account structures, income taxes etc. Creating reasonable expectations is one of the benefits of education. Less experienced investors often request high returns with low risk, the unicorn of the investment world. Investing is always a risk/return trade-off. Risk is the price you pay for the opportunity to earn money. With tools (like diversification), portfolio managers can reduce that price but cannot fully eliminate it. We can sometimes find a price that is easier for our clients to pay, such as accepting lower liquidity instead of volatility, but the risk is still there. Setting expectations includes reminding our clients that risks exist, even if we haven’t seen the negative impacts of that risk for a long while.

Conclusion

Through all aspects of the process, portfolio managers and their firms have a fiduciary duty to act with care, honesty, and good faith, always in the best interest of their clients.3 This means that not only do we provide investment management services to help meet the financial goals of our clients, but we will also take the time to provide emotional support, educate, and explain results. We work as partners alongside our clients to help eliminate biases and coach them to informed decisions. We might not be able to pick the best-performing investments for next year, but we can build a portfolio best suited to the needs of our clients.

Sincerely,

Emily Hofmann, CIM®, CFP®

Portfolio Manager

Disclaimers and Disclosures

- Larrabee, David. “Setting the Record Straight on Asset Allocation.” Enterprising Investor, CFA Institute, 16 Feb. 2012, blogs.cfainstitute.org/investor/2012/02/16/setting-the-record-straight-on-asset-allocation/.

- Smith, Hans. “Https://Www.Onedayinjuly.Com/the-Cycle-of-Investor-Emotion.” The Cycle of Investor Emotion, 3 June 2022, www.onedayinjuly.com/the-cycle-of-investor-emotion.

- What is a portfolio manager?. PMAC. (n.d.). https://pmac.org/nav-investor-info/selection-checklist/