Investing In Your Retirement. Start Now, Not Later

Campbell River Seawalk

Out of the four seasons, Spring is my favourite. The days are getting longer, flowers are starting to bloom, and of course, the weather gets nicer. With the change in the weather, I get excited about running outdoors (without rain gear). I find running is a good way to clear my mind, listen to some of my favourite music, and get some dopamine going.

I find that the first few runs of the season are the hardest. One of the motivators to make me put on my shoes and get out there is reminding myself it is for long-term gain. And that running and keeping in shape in my 30s will keep me healthier in my 50s,60s, and 70s. By taking care of myself now, I can “compound” the benefits for the long term without having to work as hard later on in life to maintain my health. Working in finance, naturally, made me think about the concept of “Compound Interest” and how it has a similar principle: starting now has huge long-term benefits.

You may have heard about compound interest before, but what does that actually mean? Compound interest is receiving interest on the money you initially invested (principal), and also receiving interest on previously accumulated interest. You can think of this as “interest on interest”, and this is fundamental for accumulating wealth. Why? Compound interest causes your investments to grow exponentially (non-linear) and the longer you invest, the larger the growth.

For people in their 20s and 30s, it is often easy to overlook investing as there are other expenses that feel more important, or they can catch up in the future when they are earning more. Yet these are the years where compound interest provides the most benefit, as saving small amounts now can have huge payoffs later. By having your money invested in your 20s, 30s, and 40s working for you significantly outpaces those that start investing in their 50s and 60s.

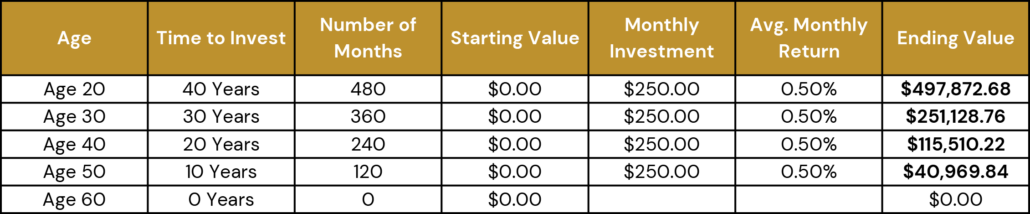

To help illustrate this concept1, let us look at the table below that shows how a monthly investment of $250 with an average positive return of +0.5% per month (this comes close to 6% per year) grows over time.

From the table above the person who started investing with $250 a month at Age 20 would have a portfolio close to $500,000 by age 60. If one were to defer until Age 30 to start investing, their ending portfolio would be about $250,000, roughly half if they had started their contributions 10 years prior.

To look at it in a different way, let us go through an example where we want to have a portfolio value of $1 million at Age 60. If this is our end goal, how much would we need to invest per month to achieve it at Age 20, 30, 40, or 50?

From the second table, if you started investing at Age 20 you would only need to invest roughly $500 per month to achieve this goal. As we look at Ages 30,40 & 50, we see that the monthly contributions exponentially increase as a person defers investing for later.

The earlier you start investing, the less money you need to allocate to their investments to fund your retirement. The other takeaway here is that no matter the age, the benefits of compound interest “compound” (pun intended) with investing more funds NOW, as opposed to later.

As Warren Buffet once said, “Someone’s sitting in the shade today because someone planted a tree a long time ago”.2 The best time to invest was yesterday, the second-best time is today.

Like a lot of things in life (health, studying, blog writing) it is better to start earlier than to delay. Investing is no different. The earlier one starts, no matter how small, the easier things become in the long run due to the exponential growth courtesy of compound interest. Hopefully, this article helps illustrate this concept and motivates you to put on the financial “running shoes” and get going.

Harrison Brown, CFA

Associate Portfolio Manager

Our Team at Alitis

Our dedicated team at Alitis has over 250 years of collective industry experience. But what makes us unique is the high level of integrity that every team member brings to the table.

Along with experience and integrity, each team member at Alitis shares the same commitment to our clients. At the end of the day, we measure our success based on the success of you reaching your financial goals.

If you’re interested in investing with Alitis, let’s have a conversation:

Disclaimers and Disclosures

- Fernando, Jason. “The Power of Compound Interest: Calculations and Examples.” Investopedia, 28 Mar. 2023, www.investopedia.com/terms/c/compoundinterest.asp.

- Johnson, Jamie. “10 Warren Buffett Quotes.” CO by U.S. Chamber of Commerce, 27 Jan. 2020, www.uschamber.com/co/start/strategy/warren-buffett-quotes-for-businesses.