When to start taking CPP

The Canadian Pension Plan or “CPP” is something most Canadians are familiar with, and as they approach retirement age, look forward to finally cashing in on the contributions they have made over their working career.

The CPP was created in 1965 with the goal of replacing up to 25% of an employee’s lifetime earnings. In 2016, the federal government introduced a CPP reform bill that aimed to eventually cover 33% of the employee’s average lifetime earnings.

The amount each person receives from CPP will vary based on their lifetime contributions to the program, their average annual earnings, and when they start receiving their pension benefits.

When to start taking CPP

The question of when one should start taking CPP is a conversation many Canadians discuss with their friends and family as they are approach retirement. However, it is important to remember that everyone has a unique situation, and what your friends or neighbors do, may not be the right decision for you.

Canadians can start taking CPP when they turn 60 or can be delayed as late as age 70. The age at which you start collecting CPP will impact the amount you receive.

By taking the CPP retirement pension early, it is reduced by 0.6% for each month you receive it before age 65. By delaying CPP, your monthly payment will increase by 0.7% for each month you delay.

The decision on when to start taking CPP needs to consider a variety of factors including your finances, life expectancy, and taxes.

Finances

Your current finances may be one of the most important factors to consider. If you are retiring and will rely on CPP income to cover your cost of living (food, shelter, and clothing) or to repay debt, then it likely makes sense to start collecting CPP as soon as it becomes available at age 60.

If you have other sources of income such as a company pension, RSP savings to draw on, or rental income, you will have more flexibility on when to start collecting CPP.

Life Expectancy

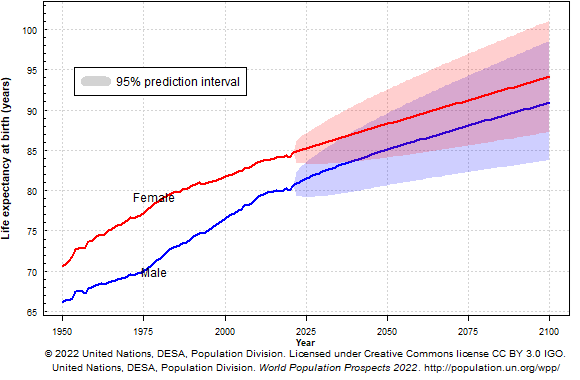

Although death is a topic many like to avoid, it is an important factor to consider when taking CPP. While this analysis should consider your current individual health situation, you should also keep in mind that life expectancy for Canadians continues to grow. According to the United Nations, the life expectancy of Canadian males will be 85 years by the year 2050. Female life expectancy will exceed 87 years by 2050.1

Chart: Life expectancy at birth by sex (Canada)2

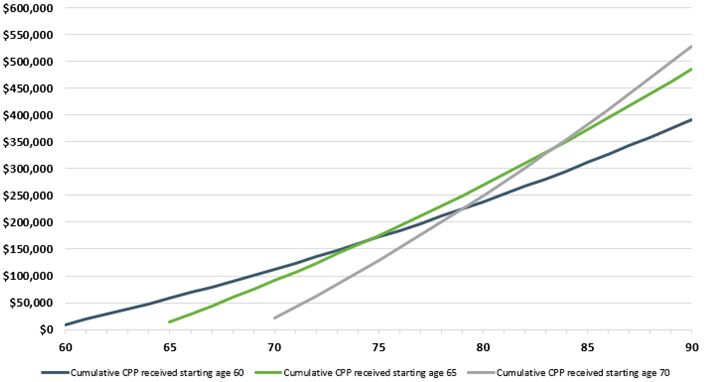

According to the chart below, if your estimated life expectancy is above 75 but below 84, the expected cumulative CPP received will be optimized by starting to take CPP at age 65.

If your estimated life expectancy is above 84, delaying CPP until age 70 will result in a higher cumulative amount of CPP received.

Comparison of your cumulative CPP received starting at age 60, 65 and 70

Taxes

If you have sources of income other than CPP, it is important to consider the tax implications of taking your CPP. CPP is considered taxable income and therefore will be taxed at your marginal tax rate. Ideally, you will be able to work with your Financial Planner and your accountant to ensure the timing of your CPP and other sources of income to minimize your effective tax rate through your retirement years.

Summary

The decision of when to start taking your CPP is unique to each individual and needs to account for the factors discussed above. Deciding on when to take CPP is an important piece of a comprehensive financial plan that should be considered as you approach retirement.

If you are approaching retirement, please reach out to us to discuss the creation of a plan that can help you achieve your retirement goals.

Disclaimers and Disclosures

- United Nations, Department of Economic and Social Affairs, Population Division (2022). World Population Prospects 2022, Online Edition. https://population.un.org/wpp/Download/Standard/Mortality/

- United Nations. (n.d.). World Population Prospect 2022. Canada: Life expectancy at birth by sex. Retrieved October 21, 2022, from https://population.un.org/wpp/Graphs/DemographicProfiles/

What Age to Start Your CP Retirement Pension. Government of Canada, https://www.canada.ca/en/employment-social-development/campaigns/cpp-choice.html#h3

Canada Pension Plan Enhancement, Government of Canada, https://www.canada.ca/en/services/benefits/publicpensions/cpp/cpp-enhancement.html

CPP retirement pension: When to start your pension, https://www.canada.ca/en/services/benefits/publicpensions/cpp/cpp-benefit/when-start.html