Overview

The Alitis Growth Pool is a growth-oriented portfolio with a mix of traditional and alternative investments designed to generate a high level of capital appreciation, with the potential for some income generation, over the long term. The main features include:

- Incorporates all equity asset classes, except real estate.

- Utilizes three different approaches to equity management.

- Provides long-term growth potential for your portfolio.

How could the Alitis Growth Pool fit into your portfolio?

This investment pool was created for individuals with a 6 year and longer time horizon looking of a high level of income while providing long-term growth potential.

What asset classes does this fund use?

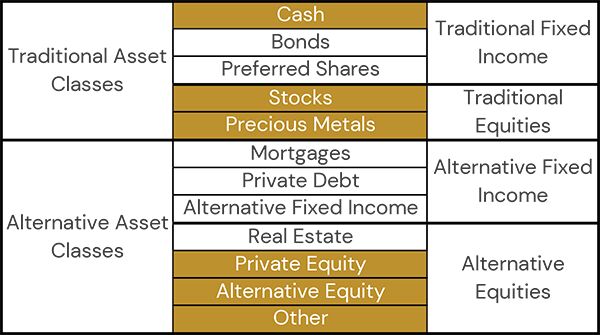

The Alitis Growth Pool is permitted to invest in cash and most types of equities, as indicated below:

* The mandate for the Alitis Growth Pool was changed in 2019 so that it would only invest in the asset classes noted above. A small portion of the Pool is still invested in real estate investments that were purchased before the change in mandate. These real estate investments will be held until the completion of the projects when payout occurs.

How is the Alitis Growth Pool managed?

Alitis selects each of the investments in the Pool as well as the allocation of these investments. On a broader level, the portfolio is split roughly into thirds, with each component acting to complement the others:

- Approximately 1/3 Managed by Alitis – Alitis utilizes a top-down global country allocation approach based on dividends, currencies, and other factors. The premise for this approach is threefold: (1) a global outlook was needed as the US stock market performed substantially better than all others for about a decade so it was likely that non-US markets would do better looking forward, (2) growth in global trade has started to slow down indicating that countries and their trading associations are becoming important once again, and (3) value stocks had underperformed growth stocks for quite some time, indicating that a shift back to value stocks was likely.

- Approximately 1/3 External Managers – These managers are generally bottom-up stock pickers who are generally not concerned about countries. Rather, they are more concerned about the prospects for individual companies or sectors. Utilizing managers such as these provides a complement to Alitis’ top-down approach and addresses our primary risk management question, “What if we are wrong?”

- Approximately 1/3 Alternative Equities – The final third of the Pool is made up of alternative equity investments that tend to act differently than traditional ones – investments such as private equity, infrastructure, hedge funds, and commodities. At different times, these investments have shown that they may enhance returns or reduce risk when added to a portfolio of traditional stocks. In essence, this component complements the traditional equity styles used by Alitis and the external managers.

At times the proportions may vary, particularly if the decision has been made to hold some monies in cash if investment conditions appear unfavourable.